March 1, 2018 – Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, today released its latest quarterly report on the Visual Processing Unit (VPU) market.

The major interest and activity in the market for Vision Processing Units (VPUs) continues to center on neural networks, both in terms of advances in the networks themselves and in the continuing entry of new architectures and participants into the field.

This issue of the report looks at a number of IPs for embedded inferencing. The vision processor market is very broad, reaching into many application areas – cloud as well as edge based. This leads to a wide divergence of approaches but inference at the edge has one unchangeable requirement that affects every device: power efficiency. Every vendor trumpets the efficiency of their solution for any given task and attempts to balance the conflicting requirements of some applications for processing performance that is simply outside the power envelope for their architecture.

STMicroelectronics has recently begun showing its answer to that problem with the Orlando platform. In common with all vendors of embedded IP, this is being promoted as a scalable solution in order to somehow bracket the various levels of performance needed but this device starts with a very different architecture that seems to give it a massive advantage right out of the gate.

Videantis, a German company with a relatively long history in producing programmable accelerators mostly for the automotive market, is in a sense the Yin to STMicro's Yang. As a company that depends heavily on software for revenue, Videantis downplays the importance of specialized hardware and relies entirely on a very standard DSP-based approach, arguing that classical vision techniques continue to be important for maximum efficiency even when DNNs are also in the system. They emphasize software continuity over revolutionary hardware, especially for their chosen focus market of automotive.

Nearly every hardware IP company now has a core aimed at neural network inferencing: Imagination Technologies joined the list late in 2017 and Arm, which had been the only major holdout, has now conceded the argument and will launch its offering in 2018. Timing is everything and the difficulty major IP companies face in getting it right illustrates the preliminary and developing nature of the VPU market.

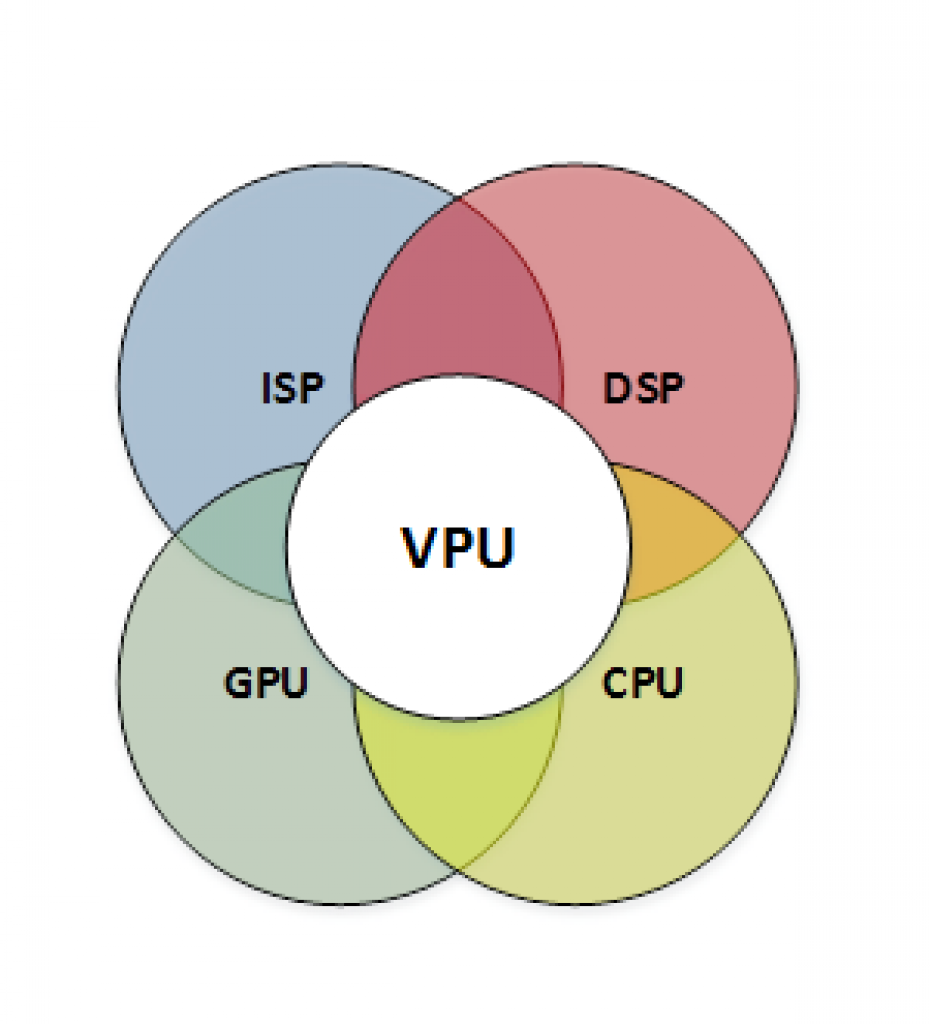

The VPU is a relatively new device but the field is already crowded with established companies bringing previous experience in DSP and GPU design to bear, as well as many startups.

We have identified 48 companies that are making VPU capable processors using GPUs, DSPs, and dedicated engines. Companies such as Intel, TI, Nvidia, AMD, and Qualcomm, don't invest millions of dollars in R&D and acquisitions unless they see a big return. Therefore, no semiconductor, system builder, or software tool, or application developer can afford to ignore this emerging, perhaps explosive, market.

The market for VPUs with deep learning continues to explode, with new applications coming out of the woodwork all the time and no shortage of startups throwing their hats into the ring. Even so, 2017 has seen consolidation of a sort, with Intel continuing its attempts to gain a foothold in the automotive market by acquiring Mobileye while Qualcomm's ingestion of NXP (if it happens) will surely affect the fortunes of Freescale's current IP supplier VeriSilicon one way or another.

The market participant table for this quarter once again shows an increased number of players but now for the first time, a new column has been added to highlight the new phenomenon of vertically integrated companies that are designing and building their own SoCs. Apple has led the charge and Google has been an eager follower but with recent rumors of Amazon taking the step into chip design, we have a full-fledged trend.

JPR's quarterly VPU report provides the in-depth information needed to access opportunities, suppliers, and competitors.

JPR's new quarterly VPU service analyzes the suppliers, the technology, the processors, and the market opportunities. As robust as the market is, there will be consolidation through either failures or acquisitions, and we think there will be just a half dozen suppliers, three major companies, and three niche players by 2020.

Where will your supplier, company, or competitors be in 2020? JPR's VPU report can help assess those opportunities and threats.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. MarketWatch is a quarterly report focused on the market activity of PC graphics controllers for notebook and desktop computing.