This article was originally published at IDTechEx’s website. It is reprinted here with the permission of IDTechEx.

Global Drone Market Set to Reach US$147.8 Billion by 2036, Driven by Commercial Expansion, Regulatory Maturity, and Sensor Proliferation

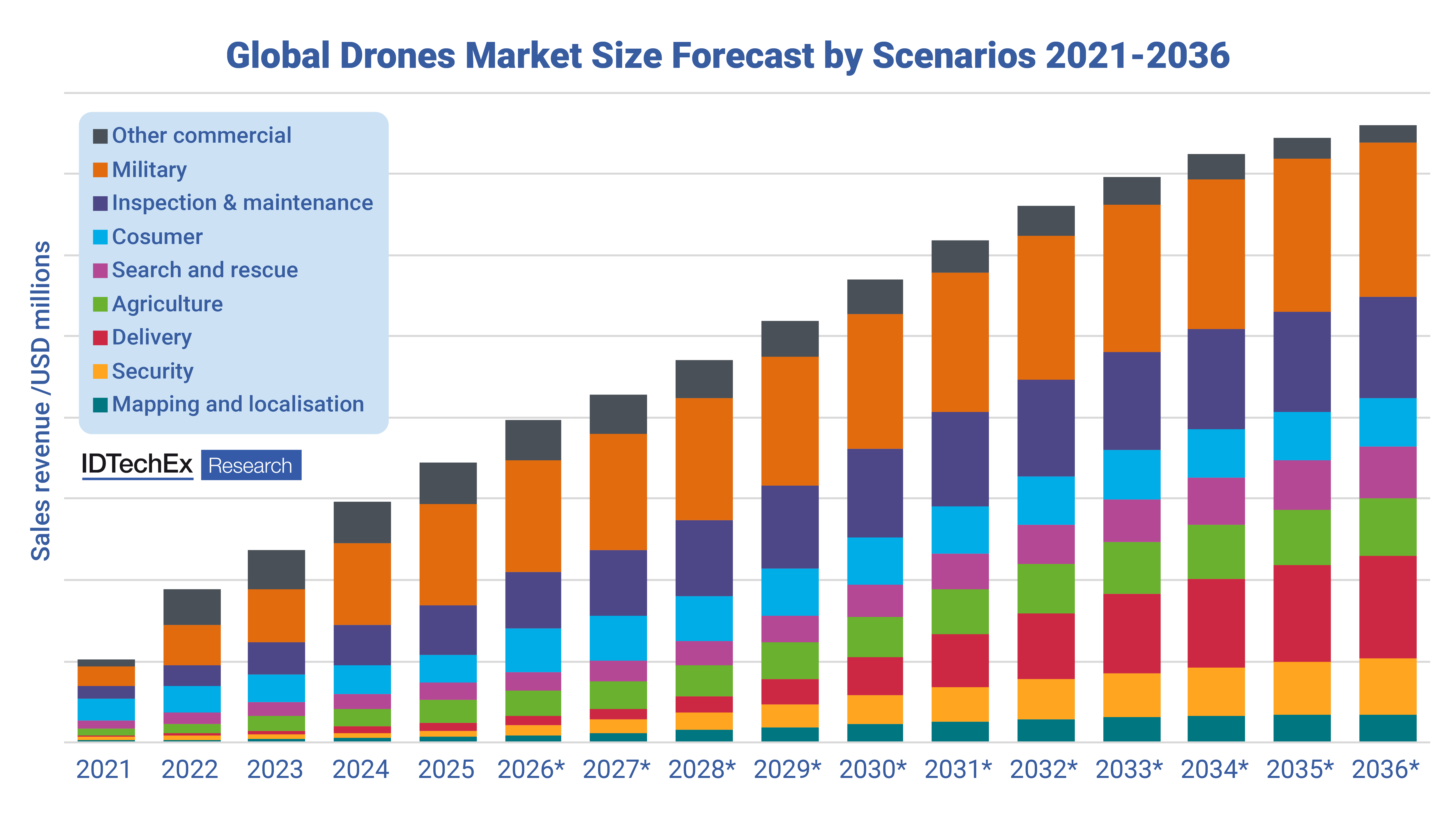

Over the past decade, drones have moved from experimental tools into critical infrastructure across agriculture, logistics, energy, security, and public-sector operations. By 2036, the global drone market, spanning both commercial and consumer platforms, is forecast by IDTechEx to reach US$147.8 billion, growing from US$69 billion in 2026, with a CAGR of 7.9%. Commercial deployments are accelerating rapidly, with unit shipments expected to surpass 9 million in 2036. This growth reflects increasing regulatory clarity, maturing technology stacks, falling hardware costs, and the transition toward autonomous, data-driven operations.

Global Drone Market Revenue Forecast (2026-2036). Source: IDTechEx

Agriculture enters the era of large-scale digital farming

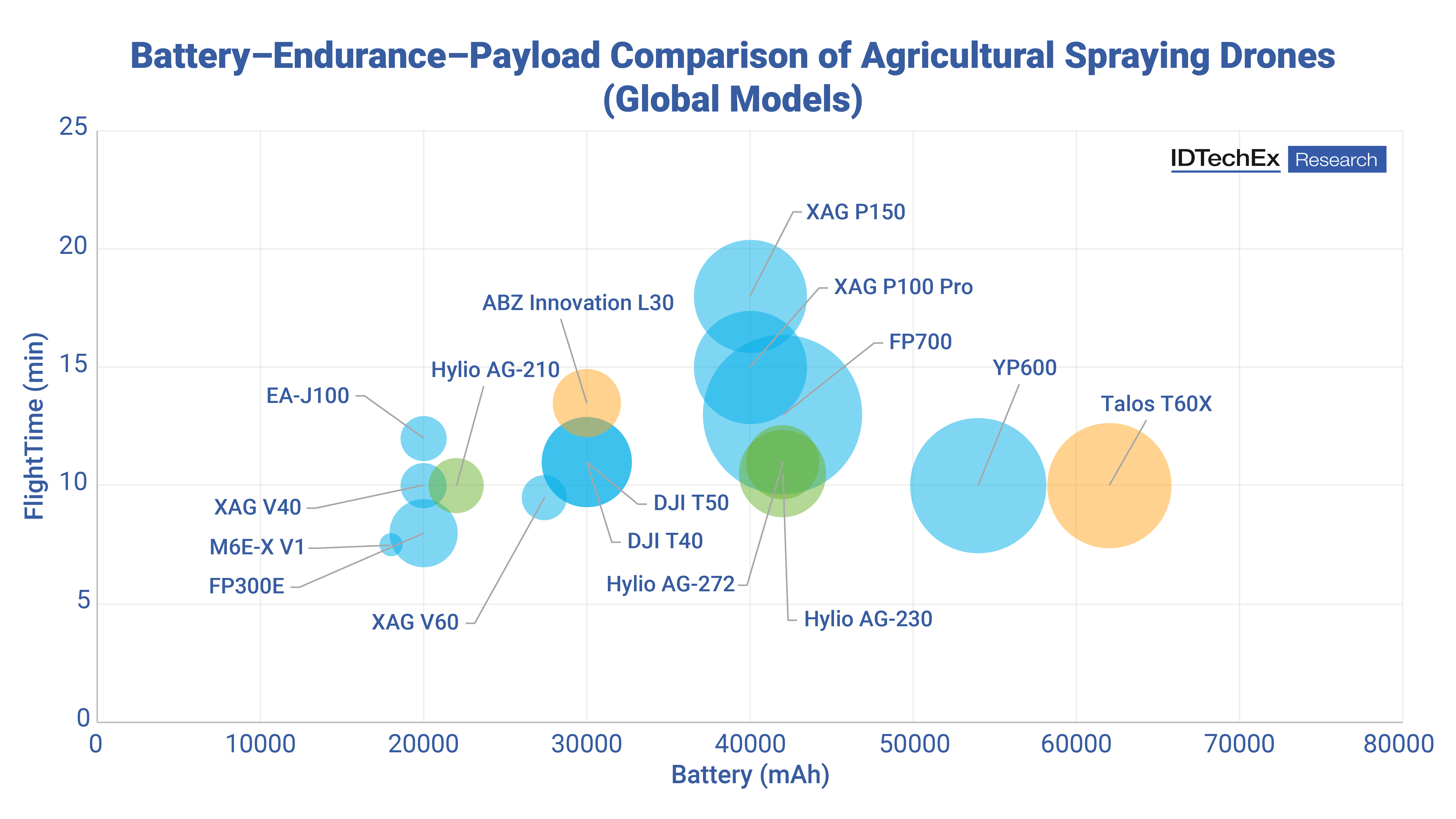

Agricultural drones have evolved from early trials to full commercial maturity, especially in China, the US, and Southeast Asia. Core applications such as spraying, seeding, and crop monitoring have become profitable and widely adopted. Multirotor platforms still dominate, but fixed-wing and hybrid VTOL (Vertical Take-Off and Landing) drones are gaining share for large-area farmland mapping and long-range autonomous missions.

In 2025, more than 30% of large farms worldwide are estimated to be using drones for field operations. Integration of AI vision, multispectral imaging, and precision analytics enables a data-centric farming model that continues to expand. Future growth will rely heavily on linking drone data with smart farming ecosystems and automated agronomic decisions.

Comparison of Battery-Endurance-Payload of Agricultural Spraying Drones. Bubble size indicates payload capacity: larger bubbles represent drones with higher liquid-carrying capacity. Colors denote regions of origin: blue = China, green = United States, orange = Europe. Source: IDTechEx

Inspection and maintenance becomes the fastest-growing segment

Energy, utilities, and infrastructure operators are rapidly shifting toward automated drone-based inspection of wind turbines, powerlines, pipelines, and oil & gas assets. Equipped with LiDAR, thermal imaging, and AI-powered defect detection, drones are replacing costly and hazardous manual inspections.

From 2025 onward, operators are expected to increasingly adopt fully automated workflows, including drone-in-a-box systems, remote fleet management, and AI cloud analytics. Inspection & maintenance is projected to exceed 25% of all commercial drone revenue by 2030, surpassing agriculture as the leading segment.

Delivery drones mature from trials to regional commercialization

Despite regulatory and logistical challenges, drone delivery is now gaining real commercial traction. Leading companies in the US, Europe, and China are expanding last-mile delivery for e-commerce, food, and medical transport, while mid-range logistics drones are emerging for remote and island supply routes.

Industry progress in automated loading, cold-chain drone logistics, and U-space/UTM (Unmanned Traffic Management) frameworks is paving the way for scaled operations. The long-term trajectory of delivery drones will depend heavily on BVLOS (Beyond Visual Line of Sight) approvals and national UTM deployment.

Security, military, and public safety maintain strong momentum

Government and law enforcement agencies are adopting drones for border patrol, surveillance, traffic management, crowd monitoring, and emergency response.

Hybrid fixed-wing VTOL drones enable long-endurance operations over large areas, while AI-based video analytics enhance situational awareness. Public safety is expected to remain a stable and steadily expanding segment through 2036.

Military drones remain the largest revenue contributor

The military drone sector continues to lead the total drone market in absolute revenue. Since 2022, regional conflicts have accelerated demand for reconnaissance drones, medium-range tactical drones, and loitering munitions.

Armed forces are also moving toward Manned-Unmanned Teaming (MUM-T) concepts, integrating drones with aircraft and armored vehicles. While dual-use technologies are increasingly repurposed for defense, the core military drone segment will continue to be highly profitable and strategically essential.

Disaster response continues to rely on drone capabilities

Drones equipped with thermal, optical, and acoustic sensors play a critical role in night-time search missions, earthquake rescue, wildfire monitoring, and post-disaster assessment.

Advances in multi-drone collaboration and AI-based geolocation algorithms have significantly improved operational efficiency. Though smaller in absolute revenue, this segment has strong government backing and consistent long-term growth.

Global regulations move toward harmonization and risk-based frameworks

Drone regulation is increasingly aligned around risk-based, tiered certification systems. The US (Part 107), EU (C0-C6), UK (CAP722), and China have all established clearer pathways for commercial operations, especially for BVLOS.

Common regulatory themes include:

- Maximum flight heights around 120 m

- Mandatory registration and pilot certification

- Stricter rules for BVLOS and operations over people

- Airspace access via automated or digital authorization

North America and the EU lead in harmonized frameworks, while Asia-Pacific, Latin America, and MENA remain more fragmented.

Sensor proliferation reshapes drone payload configurations

From 2025 to 2036, commercial drone shipments are expected to grow 2.3×, but sensor shipments grow 4×, illustrating a major shift toward higher sensor density and more advanced autonomy.

By 2036, many industrial and BVLOS drones are expected to exceed 10-15 sensors per drone, driven by:

- Multi-camera vision systems

- Higher-performance LiDAR and radar

- Ultrasonic and pressure sensors for low-altitude control

- Barometric altimeters

- Multi-IMU redundancy for high-reliability missions

A fully rebuilt 2026-2036 forecast from IDTechEx

This report offers a comprehensive overview of the global drone industry’s progress across consumer, commercial, and defense sectors, including the regulatory constraints that shape operations and the deployment maturity in different regions. It also examines the full range of sensing and payload configurations used across major applications, from agriculture and inspection to logistics and public safety, explaining how different cost structures and mission requirements drive platform choices. Additionally, it includes a detailed list of representative commercial drone models, their technical specifications, sensor suites, pricing ranges, and market positioning, together with a fully updated 2026-2036 forecast covering revenue, unit shipments, and sensor integration trends.

IDTechEx provides a completely updated ten-year drone market forecast, including:

- Global revenue projections for consumer & commercial drones

- Unit shipments by fixed-wing vs rotary platforms

- Scenario-based forecasts across 8 key commercial applications

- Detailed sensor-per-drone modeling

- Drone sensor market size forecasts (2026-2036)

Key Aspects

This report provides critical market intelligence about the global drone industry, covering consumer, commercial, and defense platforms and all major application sectors. This includes:

A review of the context, technology, and regulation behind drone systems:

- History and context for the global drone market and each major application sector

- General overview of key drone platform types (multirotor, fixed-wing, hybrid VTOL) and autonomy / navigation stacks

- Overall look at technology trends in payloads and sensor integration, including multi-sensor configurations for BVLOS and industrial use

- Review of global regulatory developments and risk-based frameworks shaping commercial drone operations

Full market characterization for each major drone application sector:

- Agricultural drones, including spraying, seeding, crop monitoring, and integration with digital farming ecosystems

- Inspection and maintenance drones for energy, utilities, and infrastructure assets, including drone-in-a-box and automated workflows

- Delivery drones, from last-mile services to mid-range logistics and medical transport, and their UTM / U-space requirements

- Security, public-safety, and disaster-response drones, including long-endurance hybrid VTOL platforms and AI-driven situational awareness

- Military and defense drones, including tactical systems, reconnaissance platforms, loitering munitions, and Manned-Unmanned Teaming concepts

Market analysis throughout:

- Reviews of drone industry players throughout each key sector, including representative commercial models, sensor suites, payload capabilities, and pricing ranges

- Historic drone market data and deployment trends, together with a fully rebuilt 2026-2036 forecast for global drone revenue and unit shipments

- Detailed 2026-2036 forecasts for the drone sensor market, including sensor-per-drone modeling, shipment volumes, and revenue projections

| Report Metrics | Details |

|---|---|

| Historic Data | 2021 – 2025 |

| CAGR | The global drone market is forecast to reach US$143 b by 2036, growing with a CAGR of 10%. |

| Forecast Period | 2026 – 2036 |

| Forecast Units | volume(units), Revenue (USD, millions) |

| Regions Covered | Worldwide, Brazil, Europe, China, United Kingdom, United States |

| Segments Covered | Commercial drones, Consumer drones, Fixed-wing UAVs, Rotary UAVs, Agriculture drones, Inspection drones, Logistics drones, Military drones, Search-and-rescue drones, Drone sensor technologies (IMU, cameras, LiDAR, radar, pressure, ultrasonic, altimeters), Autonomy technologies (SLAM, FCU, localisation, swarm control). |

Analyst access from IDTechEx

All report purchases include up to 30 minutes telephone time with an expert analyst who will help you link key findings in the report to the business issues you’re addressing. This needs to be used within three months of purchasing the report.

Further information

If you have any questions about this report, please do not hesitate to contact our report team at [email protected] or call one of our sales managers:

AMERICAS (USA): +1 617 577 7890

ASIA (Japan and Korea): +81 3 3216 7209

ASIA: +44 1223 810259

EUROPE (UK): +44 1223 812300

Shihao Fu, Technology Analyst, IDTechEx

Yulin Wang, Senior Technology Analyst, IDTechEx