This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

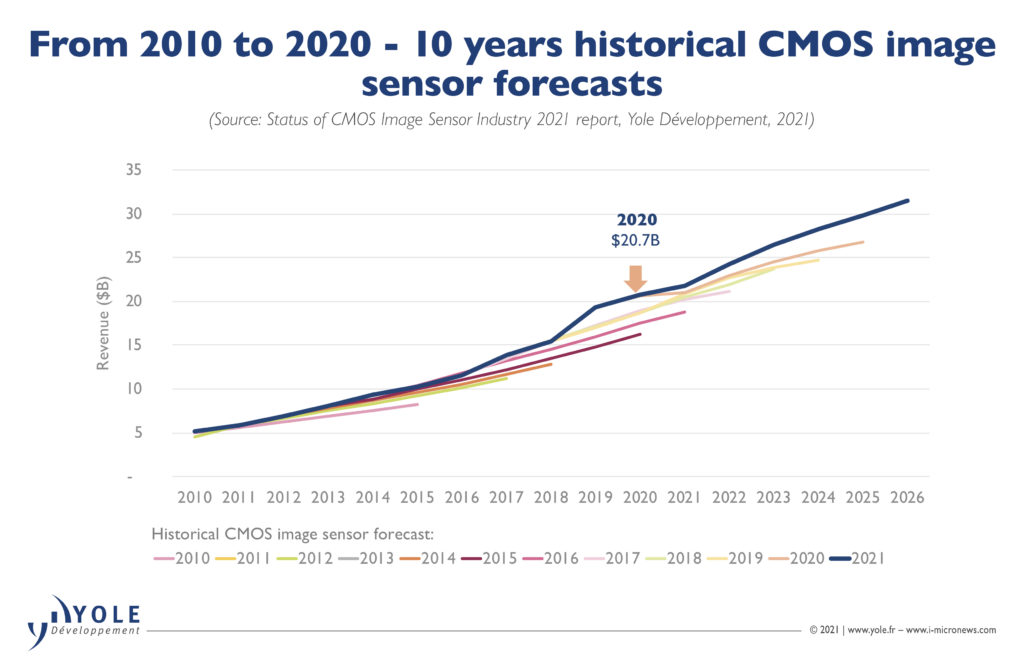

The CMOS Image Sensor industry maintained significant 7.3% YoY growth in 2020, reaching $20.7B.

OUTLINE:

-

Market forecasts:

Yole Développement (Yole) forecasts the CIS market, to reach US$31.5 billion by 2026.

The CIS industry represents 4.7% of the US$440 billion global semiconductor industry, this share stayed unchanged from 2019.

Mobile remains the most important application for CIS, representing 68% of market revenues.

Security and automotive applications have emerged with explosive growth in the range of 40% YoY.

-

Technology trends:

The technology race remains a key aspect of CIS competition.

Over the years, significant improvements have been made to the CIS manufacturing process.

The next technology challenge should be the integration of AI within CIS sensors.

-

Supply chain:

As of 2020 Sony remains the biggest CIS player, with a market share of 40%.

This is compared to Samsung’s 22%, Omnivision’s 11%, and STMicroelectronics’ 6%.

These top players are all focusing on mobile applications either in imaging or sensing applications.

.jpg)

“Until 2019 mobile device cameras were the main growth contributor to the CIS market.” asserts Pierre Cambou, Principal Analyst, Imaging at Yole Développement (Yole). He adds: “But in 2020 this is no longer the case. Computing, automotive and security market applications have now outpaced the growth of mobile device.”

The US$20.7 billion CIS industry is still heavily dominated by mobile and consumer applications, representing more than 72% of revenues. Yet, despite all headwinds in 2020, computing, automotive and security have each grown to similar shares, reaching about 8% of CIS revenues, and 23% combined. They had represented 21% in 2019. In computing, higher demand for laptops and tablets in the COVID-19 context combined with the introduction of sensing cameras, such as 3D and fingerprint, has reversed a multi-year downward trend. In automotive and security, the high demand for cameras comes from smart car, smart home, and smart building trends.

In this context, Yole investigates disruptive technologies and related markets in depth, to point out the latest innovations and underline the business opportunities.

Released today, the Status of CMOS Image Sensor Industry 2021 report contributes to the ecosystem identification and analysis. Including market trends and forecasts, supply chain, technology trends, technical insights and market segmentations, take away and outlook, this study also delivers an in-depth understanding of the ecosystem and main players’ strategies.

What is the status of the CIS industry? What are the main technical challenges? What are the key drivers? Who are the suppliers to watch, and what innovative technologies are they working on?

Yole presents today its vision of the CIS industry.

As analyzed by Yole’s team in the new Status of CMOS Image Sensor Industry 2021 report, some future growth of the CIS market will therefore come from those markets, although mobile will still play a major role due to its sheer size. Looking more precisely at the growth forecast for mobile, social media has completely redefined our relationship to phones. Future technology for phone cameras will therefore primarily serve social media applications.

According to Chenmeijing Liang, Technology & Market Analyst, Imaging, within the Photonics, Sensing & Display Division at Yole: “We expect the production volume of mobile handsets to resume an upward trend in 2021, growing by 11.5% YoY, which is the major contributor to Yole’s CIS forecast upgrade. The combined need for real time distant communication and expression is rising. Combined with the growth of the other markets, the CIS industry should at least keep growing at 7.2% CAGR for the five years ahead”.

2020 saw the combination of continuing high demand for cameras and sanctions on Huawei contributing to additional purchases of CIS in three quarters and then a brutal stop in the last quarter of the year.

The COVID-19 pandemic did not play much role other than limiting capacity increases.

For Pierre Cambou: “The CIS industry output stayed close to its structural limit all through the year, and especially in Q3-2020. For the full year, the whole industry grew by 7.3% YoY in revenue, in line with Yole’s expectation. For CIS players, 2020 did not play out similarly to 2019, in fact it was almost the opposite, with the smaller players doing best. Sony didn’t grow, but Samsung grew 13%, OmniVision, Smartsens and SK Hynix grew about 30%, while Galaxycore grew 52% YoY”.

The dynamics of the Chinese players must be rationalized in the context of US-China trade tensions. CIS is one of the key strengths of the relatively small Chinese semiconductor sector.

The tight links with Taiwanese foundry TSMC and the availability of new capacity at the Chinese foundries HLMC and SMIC have been highly profitable. Similarly, Korean players and foundries have benefited greatly in this context. And for years to come semiconductor shortages may still dominate the economic landscape. Again, the Huawei ban is probably much to blame for the herd reaction for inventories we are currently seeing. It will take at least a few years before the bubble of the current rush for capacity bursts. Other semiconductor areas like memory or microprocessors have experienced this, but the CIS industry never has, we now must keep it in mind.

All year long, Yole Développement publishes numerous reports and monitors. In addition, experts realize various key presentations and organize key conferences.

In this regard, do not miss the Smartphone flagship battle: from sensors to modules to image quality – Webcast on August 31, 2021. This webcast will present and compare information about the front and rear red/green/blue cameras from the three smartphone market leaders, Samsung, Huawei, and Apple, based on detailed optical and scanning electron microscope images of the modules and the image sensors. Moreover, the webcast will provide insight into the design choices, manufacturing technologies, supply chains, and costs that went into them.

Will present:

- Chenmeijing Liang, Technology & Market Analyst, Imaging, Yole Développement

- Peter Bonnano, Technology & Cost Analyst, Imaging, System Plus Consulting

- Hervé Macudzinski, Image Science Director, Dxomark

Register on i-Micronews!

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews. Stay tuned!

Extracted from:

- Status of CMOS Image Sensor Industry 2021 report, Yole Développement, 2021

Acronyms:

- CIS: CMOS image sensor

- YoY: Year-over-Year

- AI: Artificial Intelligence

- CAGR: Compound Annual Growth Rate