This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Functionalities like Active noise cancellation, 3D audio, and beamforming are expanding the audio market.

OUTLINE:

-

Market evolution and figures:

The audio industry is entering a new phase, with new technologies, more software and more algorithms enabling improved performance and increased value.

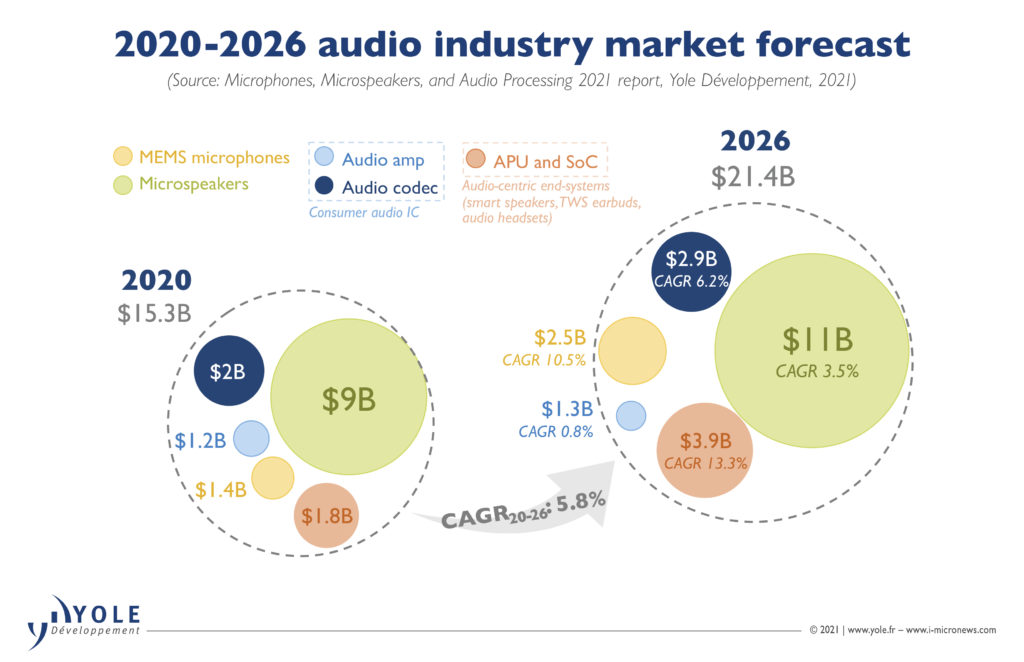

The MEMS microphone segment will reach ~US$2.5 billion in 2026 at 10.5% CAGR20-26.

Microspeaker will be the largest market segment of the audio industry with US$11 billion in 2026.

APU and SoC will also grow significantly between 2020 and 2026 with a 13.3% CAGR.

-

Technology trends:

Microphones are increasingly being integrated into all types of consumer devices to support smart assistant integration and immersive audio experiences.

Integration of audio processing and AI computing functions inside APUs or SoCs for specific end-systems is another major trend.

In addition, TWS earbuds are becoming a commodity product, boosting sales of audio related components.

-

Supply chain:

Audio ecosystem and various players are developing rapidly at all levels of the value chain.

On the microphone side, Goermicro, Knowles and AAC are the uncontested leaders.

Other players have blossomed with significant results: MEMSensing, Zilltek, and Gettop are now part of the playground.

Integrating audio processing and AI computing functions is increasing share of the APU/SoCs proposed by large players such as Qualcomm and MediaTek.

“Today, audio technologies are becoming ubiquitous, reminiscent of the hi-fi boom in the 1960s and 1970s.” asserts Alexis Debray, Ph.D., Senior Analyst at Yole Développement (Yole). He adds: “Audio is the new must-have interface to interact with phones, speakers, cars, and even homes. Audio is also bringing new immersive experiences with ANC , and 3D audio, but also sound transparency to better connect with reality”.

Considering the market for MEMS microphones, microspeakers, audio codecs, and amplifiers for consumer systems, as well as APUs and SoCs for audio-centric end-systems like smart speakers, TWS earbuds, and audio headsets, analysts expect the market to grow from US$15.3 billion in 2020 to US$21.4 billion in 2026 with a CAGR of 5.8%.

The highest growth rate will be seen in dedicated APUs and SoCs for audio-centric end-systems.

For Adrien Sanchez, Technology & Market Analyst, Computing & Software at Yole: “This is driven both by the growth of audio-centric end-systems, by the integration of new functionalities to rise audio quality and by the progressive integration of smart assistant functionalities directly at the edge.”

The market is expected to have a 13.3% CAGR between 2020 and 2026, from US$1.8 billion in 2020 to US$3.9 billion in 2026. MEMS microphones are the components forecast to have the second-highest growth rate between 2020 and 2026, a 10.5% CAGR from US$1.4 billion to US$2.5 billion. This growth can mainly be attributed to an increasing attachment rate of microphones in most end-systems, enabling a multitude of functionalities and enhancing the audio experience.

Yole and its partner System Plus Consulting, the reverse engineering and costing company, collaborated to produce in-depth analyses fully dedicated to the audio industry and products.

Both companies combined their technical expertise and market knowledge to deliver a deep understanding of the current challenges.

In this dynamic field, the market research and strategy consulting company, Yole, releases today its annual analysis: Microphones, Microspeakers, and Audio Processing 2021 report. The aim of the underlying research was to analyze the major technological trends, thus providing a thorough understanding of the value chain, infrastructure, and players in the microphone, microspeaker, and audio IC market. This new edition is also an excellent opportunity to highlight the growing importance of the APU and SoC market segments, completely dedicated to audio applications.

System Plus Consulting also shares its expertise with an in-depth comparative review of the MEMS microphone technology and cost of 19 components in the Consumer MEMS Microphones Comparison 2020 report. Microphones selected by System Plus Consulting’s analysts have been developed by the leading microphone suppliers: Knowles, Goermicro AAC Technologies, STMicroelectronics, TDK InvenSense, TDK Epcos, Cirrus Logic, and Vesper.

Inspired by the science fiction TV series Star Trek, Amazon Alexa was first released in 2014, marking the beginning of a ubiquitous voice human-machine interface era. Initially dedicated to smart speakers, the technology has rapidly expanded to smartphones. The technology is now going further into smart TVs, smart homes, AR and VR headsets, cars, and wearables, including smartwatches, earbuds, and headsets.

According to Pierre Delbos, Technology & Market Analyst in the Photonics & Sensing division at Yole: “Among all these systems, TWS earbuds are experiencing a particular boom, both in volume and technology. From a sub-million market in 2015, the TWS earbud market is expected to reach 859 million units in 2026, getting closer to smartphone volumes each year, which are expected to be 1.4 billion units in 2026”.

The market offers a wide range of price points, from US$10 for QCY (T1C earbuds) to more than US$200 for Apple (AirPods). These tiny devices are packed with lots of tech and components, up to six microphones per pair of earbuds (for the high-end models such as AirPods), dedicated audio codec chips, and highly audio capable SoCs. And as the ear canal is not getting any larger, this means that space management is one of the highest priorities for TWS end-system manufacturers. Miniaturization of components is also of paramount importance for the device/sensor makers.

Microphones and other audio components are also making their way into cars in several applications. One of these applications is voice interaction, as in other systems. While voice interaction is particularly useful as the driver’s hands are both busy operating the vehicle, the ambient noise inside the car must also be considered. Therefore, another increasingly important application for automotive audio is RANC . By using active noise control, the noise in the car can be actively reduced. As well as improving the comfort of passengers, the technology also allows car makers to remove sound-absorbing and vibration-dampening materials. This reduces the car’s total weight and improves fuel efficiency or maximum range. For sure, Yole’s analysts are going through exciting and fast-changing times, where audio technologies become a key piece of our daily interaction with every device, with voice taking a more central role as a HMI. Thriving innovation and ecosystem movements will keep pushing this industry forward.

Throughout the year, the Yole Group of Companies, including System Plus Consulting and Yole Développement, publishes numerous audio-dedicated reports. In addition, experts realize various presentations and organize key conferences.

In this regard, do not miss Dimitrios Damianos, Senior Technology & Market Analyst, part of the Photonics & Sensing division at Yole, presentation on Microspeaker & MEMS Market Status 2021 done last October at SEMI MSEC. Find it on i-Micronews in the sensing thematic!

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews. Stay tuned!

Extracted from:

- Microphones, Microspeakers, and Audio Processing 2021 report, Yole Développement, 2021

- Consumer MEMS Microphones Comparison 2020 report, System Plus Consulting, 2021

Acronyms:

- MEMS: Micro Electro-Mechanical System

- CAGR: Compound Annual Growth Rate

- APU: Application Processor Units

- SoC: Systems-on-Chips

- TWS: True Wireless Stereo

- ANC: Active Noise Cancellation

- AR: Augmented Reality

- VR: Virtual Reality

- RANC: Road Active Noise Cancelling