This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Set to demand US$3.6 billion worth of CIS in 2027, dominated by Chinese camera players and with edge computing emerging, security imaging is changing drastically.

OUTLINE:

-

CIS revenue for security applications is growing rapidly, by 32.5% from 2020 to 2021.

-

Image sensor performance and the emergence of edge computing are key for the security industry.

-

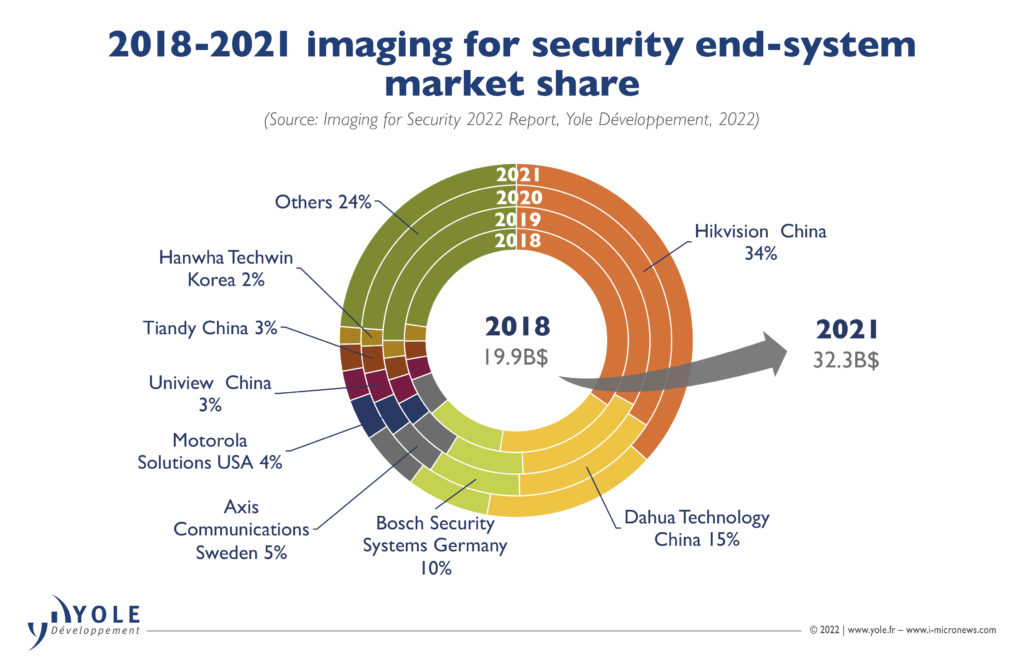

At camera level, Hikvision and Dahua represent about half the market value, with limited impact of the US ban on their overall business.

Lyon, France, March 17th 2022 – The market research and strategy consulting company, Yole Développement (Yole) has developed a core imaging expertise with a dedicated team of technology and market experts. All year long, Yole’s analysts deliver a comprehensive understanding of the imaging industry, combining technical trends and market evolution. The company publishes important analyses, including technology and market reports, quarterly market monitors, and teardowns throughout the year. More information.

Today, Yole’s imaging team releases the Imaging for Security 2022 report. This technology and market study analyzes the challenges and opportunities of this industry in detail. Yole provides an overview of the technologies as well as detailed market data. The company also delivers a valuable understanding of the value chain, infrastructure, and competitive landscape.

Florian Domengie, Ph.D., Senior Technology and Market Analyst at Yole asserts: “In the last five years, the security segment of the total CIS market has almost doubled: from 6% in 2017 to 11% in 2021. Without doubt, security has become the second largest market segment after mobile devices. From 2021 to 2027, revenue is expected to increase from US$2.16 billion to US$3.67 billion. We announce an 8.9% CAGR for this period, with 735 million units shipped in 2027.”

Who is behind those impressive market figures? At image sensor level, Omnivision is confirmed as the most important sensor supplier. It is followed by Smartsens, Galaxycore, SK Hynix, SOInc, Samsung, Sony, Onsemi, Canon, Panasonic, Pixart and Himax.

At camera level, Hikvision and Dahua represent about half the market value. In the US, Motorola is strengthening its position through multiple recent acquisitions.

The European players Bosch and Axis are maintaining their leading positions, particularly in the fields of infrastructure and smart building surveillance.

Supply chain in China already has the main CIS leaders, camera manufacturers giants, and significant processing capabilities. Hardware suppliers are increasingly partnering with software providers. In the field of video analytics, significant funds are being raised, for example for autonomous checkout applications. For more information, please visit the webpage: Imaging for Security 2022.

Acronyms:

- CIS: CMOS Image Sensor

- CAGR: Compound Annual Growth Rate