This market research report was originally published at the Yole Group’s website. It is reprinted here with the permission of the Yole Group.

13% growth in 3D sensing from intensified technological developments, countering the slowing mobile market.

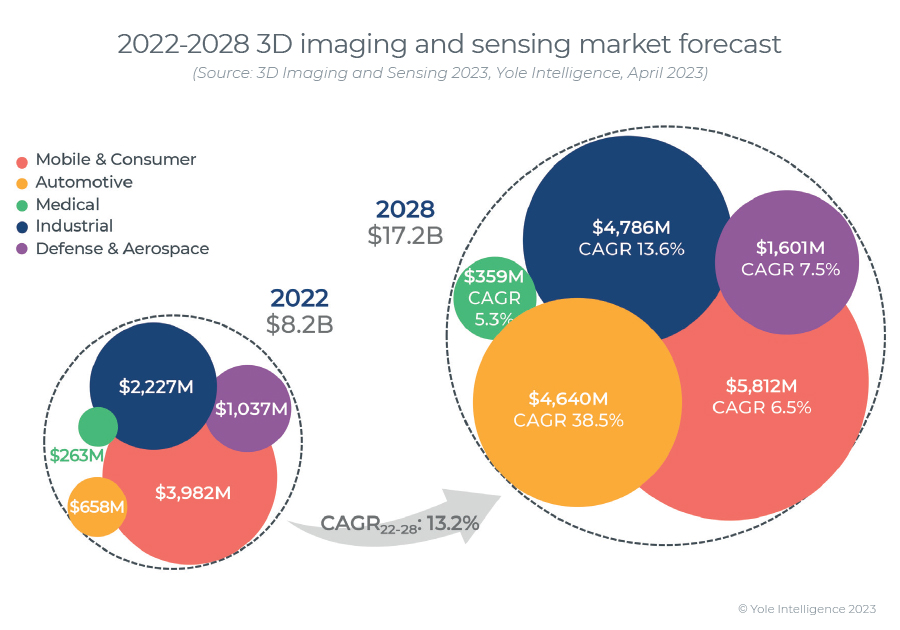

The 3D imaging and sensing market generated $8.2B in revenue in 2022. 409 million units were shipped, the majority of which were for the Mobile and Consumer markets. However, limited recent design wins have led to a downward revision of revenue growth in this segment. ToF technology is increasing its market share, while structured light is expected to decline. The action in 3D sensing is moving from mobile to more market diversification with automotive and industrial applications. Smart home applications, including drones, XR headsets, vacuum cleaner robots, smart door locks, and home appliances, will double their share of the market by volume, while the Automotive market will experience impressive growth in ADAS LiDAR and in-cabin sensing, pushed by the trend for autonomous and new-energy vehicles. By 2028, the total 3D imaging and sensing market is expected to more than double to $17.2B.

88% of the consumer 3D camera module market held by the top 9 companies

The TOP 9 companies in the Mobile and Consumer 3D camera module market generated 88% of the overall revenue. The Mobile & Computing 3D sensing market is a stronghold for historical leaders, such as STMicroelectronics and Sony in sensors, with Pmd and Ams as challengers, Coherent and Lumentum in VCSELs, LG Innotek in camera module manufacturing, etc. Consequently, some leading 3D sensing companies focus on non-mobile consumer applications, such as XR, drones, smart door locks, wearables, consumer robotics, etc. This leaves room for new entrants with potential new technologies; they should target the non-mobile and non-computing markets to be most effective. In 3D sensing, STMicroelectronics’ global strategy is confirmed, whereby it addresses the mass markets with relatively lower ASP with target cumulative volumes from hundreds of millions to billions of units. In contrast, Sony continues to deliver high-resolution and higher price products.

Intense technological research and development to unlock new opportunities

3D imaging and sensing is supported by a strong technological push and intense R&D effort at the sensor, emitter, optics, and module levels. The race for a smaller pixel is expected to unlock new market opportunities and increase penetration of these technologies. One of the most desired capabilities for manufacturing is in-pixel hybrid stacking. Industrial and automotive LiDAR applications concentrate around 940nm and 1550nm, now moving slowly from NIR to the SWIR region, and LiDAR FMCW should emerge by 2027. Metasurfaces are the ultimate evolution of flat optics to decrease the cost and size of camera modules and bring new functionalities. Event-based imaging is also exploring 3D sensing for industrial inspection and XR tracking applications. SWIR sensing should bring higher 3D sensing performance, and quantum dots sensors should emerge commercially in the coming years. Single-camera 3D technology is competing with short-distance stereo at a lower cost, thanks to the specific design of the optics.