This market research report was originally published at the Yole Group’s website. It is reprinted here with the permission of the Yole Group.

The LiDAR market is at crossroads

The global LiDAR market for automotive is expected to grow from $332M in 2022 to $4,650M in 2028. It is essential to differentiate the two markets, PC & LCV and Robotaxi, as the dynamics are different.

Yole Intelligence has been following the LiDAR market since 2019, and from the start, the LiDAR market for robotaxis has always been higher than the market for passenger cars.

Indeed, the first robotaxi services were put in place in August 2016 with NuTonomy in Singapore, and a first step was reached in 2017 with the entry of Waymo and Cruise, which started in Phoenix, AZ, and San Francisco, CA. After that, we saw the entry of Chinese players such as DiDi, AutoX, and Baidu. All these players opened new services in various cities worldwide, pulling the LiDAR market for robotaxis far ahead of the LiDAR market for passenger cars.

In 2022, we are at a crossroads as these two markets generated almost the same revenue: $169M for passenger cars and $163M for robotaxi.

Growth potential differs for these two markets: a 69% CAGR between 2022 and 2028 for passenger cars compared to a 28% CAGR for robotaxi in the same period.

The PC & LCV market has taken off as 144 design wins have been monitored since 2018; 114 of them are scheduled for 2023 or later.

Chinese OEMs are clearly pushing for the integration of LiDAR in their vehicle. While EU or US OEMs limit LiDAR to the F segment, Chinese OEMs are now releasing cars in the D segment. These cars are much more affordable than those in the F segment, and a much higher volume of cars and, therefore, LiDAR will be produced.

More than 25 different Chinese OEMs are on the way to implementing LiDAR in their cars.

Market shares are changing rapidly as the market is still young

The automotive LiDAR (PC&LCV and robotaxi) ecosystem is still quite large, with 50 companies monitored. Some are already in mass production, while others are still in the R&D phase and working on the next generations of LiDAR.

Regarding the robotaxi market, few players are generating significant revenue. Hesai controls the market with 67% of the market share as their LiDAR can be found in most robotaxis, such as Cruise, Aurora, Apollo, DiDi, Pony.ai, and AutoX.

Indeed, Hesai replaced Velodyne, which previously led this market.

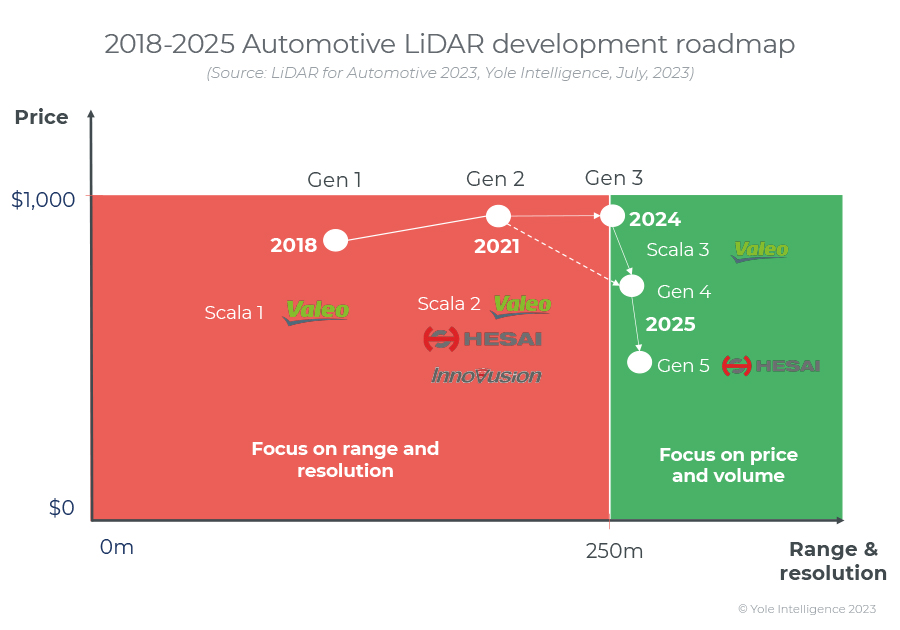

In the PC&LCV market, things are evolving rapidly and are expected to change again in the coming years. Since 2018, Valeo has been a clear leader in the market as they supplied most of the cars released with LiDAR, thanks to partnerships with Audi, Honda, and Mercedes.

In 2022, the market changed dramatically as Innovusion, which was relatively unknown before, set a high mark with more than 56,000 LiDARs shipped to Nio. Valeo was close to Innovusion, and the volume difference was only a few hundred units.

One of the most significant changes was the entry of Hesai, ranked 3rd, and the 4th place of RoboSense. These Chinese companies only started to ship in volume in 2022 and have partnerships with most Chinese OEMs.

The remaining players share the final 11% of the market with 8% for Livox due to their partnership with XPeng.

In 2023, Hesai and RoboSense are expected to lead the LiDAR market for passenger cars, taking the first two places. This is a big win for Chinese players, but Valeo is still in good shape as it communicated on a one billion dollar order for their Scala 3.

The ever-evolving landscape of LiDAR technology

In terms of technology, among the four categories we are following, only one is expected to remain roughly the same over the next ten years. In the three others, we could see significant evolutions regarding the imaging technology, the type of emitter, and the kind of photodetector used.

The wavelength is the only thing to remain stable. In 2023, near-infrared (NIR) wavelength (905 / 940nm) is expected to represent 84% of LiDAR volume for passenger cars. In the next ten years, the ratio between NIR and short-wave infrared (SWIR) is expected to remain constant.

Regarding the imaging technology, hybrid solid-state LiDAR based on a rotating mirror dominates with 68% of volumes expected in 2023, followed by MEMS-based LiDAR with 30%. In the next ten years, the share of LiDAR based on a rotating mirror should still be 56% by volume. MEMS share is expected to decrease to 7%, but the main difference could be the emergence of flash LiDAR which could take 32% of the volume in the next ten years.

This change is linked to a change in the light emitter and the photodetector. Indeed, VCSEL arrays based on multi-junction layers are improving rapidly, and, combined with SiPMs or SPADs, they will be able to offer a fully solid-state LiDAR with no moving parts.

Indeed, SiPMs and SPADs are much more sensitive than avalanche photodiodes (APD). These two components are replacing APD in the NIR region, with 60% for SiPM and 22% for SPAD in ten years.

In the SWIR region, only two types of components can be used: a fiber laser at 1,550nm and an APD. The advantages of this wavelength are linked to eye safety and the ability to have a longer detection range, but this comes at a price. The power consumption is roughly around 30W, while NIR LiDAR has a power consumption between 10W and 15W.