This market research report was originally published at the Yole Group’s website. It is reprinted here with the permission of the Yole Group.

The CMOS image sensor industry is transitioning to return to steady growth at 5.1%

CIS revenues stagnated in 2022, achieving $21.3B, in the continuity of a soft-landing situation compared to the largely inflated growth experienced in previous years. The general inflation in 2022 translated to significant slowdown in consumer products sales such as smartphones (-10%). However, higher-end CIS products and new sensing opportunities will sustain the mobile CIS market in the coming years. Automotive cameras are experiencing a large growth enabled by in-cabin, viewing, and ADAS applications, promoted further by safety regulations. The share of the mobile CIS market should continue to decrease with respect to the growing share of automotive, security, and industrial CIS, with the resulting product mix maintaining the overall ASP beyond $3. We have adjusted downward our long-term CIS forecast, with a 5.1% revenue CAGR from 2022 – 2028, and the resulting CIS revenues should reach $29B by 2028.

CIS industry leaders are experiencing different fortunes

Sony is again increasing its commanding position, while Omnivision has seen some retreating towards its pre-COVID market share. Samsung also reduced its footprint, apparently to the benefit of SK hynix. onsemi saw an exceptional 2022 boosted by the automotive and industrial markets. Galaxycore and Smartsens have retreated, apparently due to the disinflation of the low-end mobile and security camera markets. The geographical competitive CIS landscape is marked by the economic conflict between the U.S. and China. In the context of the deceleration of the mobile & computing market, and the recent temporary drop in the security CIS market, CIS Chinese suppliers are aiming to decrease their exposure to these markets while gaining market share in the thriving ones that deliver higher value and ASP: automotive and industrial. Overall, there are ongoing investments to either secure capacity or develop in-house technologies as a strategic vision to get further market share.

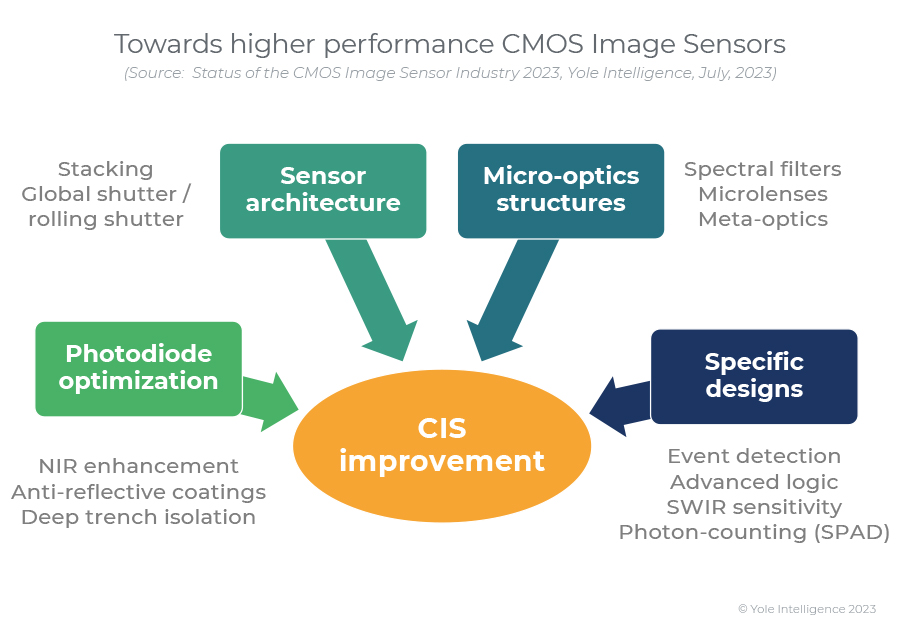

Towards higher-performance CIS with new features

In the context of a consumer market stagnation, most imaging leaders are making efforts to increase CIS values and performance or orient their product portfolio towards automotive or industrial. The industry is still seeking smaller pixels, higher signal-to-noise ratio, and higher dynamic range, while decreasing power consumption and the physical footprint of the sensor. Sony is introducing its first triple-stack sensor with pixel transistors on a separate layer for its Xperia 1 V smartphone, while Omnivision and STMicroelectronics are also investigating such architectures. For the longer term, a low-cost SWIR imaging segment is emerging to address consumer applications (e.g., tracking cameras, 3D sensing, multispectral imaging). Event-based imaging emerges as a solution for high-speed, low latency, and low-power imaging, as it ensures reasonable data load. Canon will soon introduce its first SPAD-based color camera for very-low light applications.