This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

Vehicles still use most gas sensors. Moreover, the consumer market is accelerating the digitalization of smell.

OUTLINE:

-

Market forecasts :

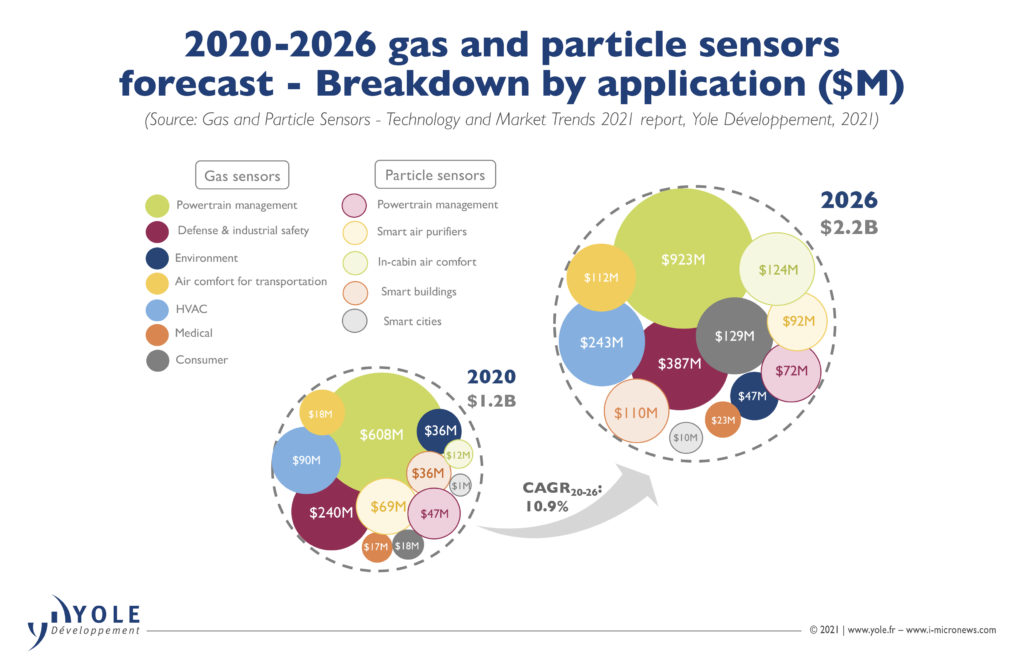

The gas sensor market is gaining momentum, forecasted to reach US$1.8 billion revenues in 2026 at a CAGR 20-26 of 10%.

The particle sensor market is showing strong dynamic on the same period with a CAGR20-26 of 16.3%, expected to reach $407M in 2026.

The consumer market is driving the growth of gas sensors with a CAGR20-26 of 39.4%.

The HVAC market, including home air purifiers, will grow to 18% CAGR20-26.

The air comfort for transportation will grow to 15,6% CAGR20-26. It represents another growth opportunity for gas and particle sensors.

Other markets like medical, environment, and defense & industrial safety are more conventional and are driven by some niche opportunities.

-

Technology trends:

Gas and particle sensors share a number of challenges at different stages of development.

Major improvements for gas sensors are miniaturization and low power consumption.

Trend is going to more combos (humidity, temperature, pressure with gas sensors) as well as electronic nose developing in parallel for digital olfaction.

-

Supply chain:

The gas sensor market is dominated by 5 companies, with almost 70% of the total market, in revenue.

They are Bosch, Delphi, NGK-NTK, Denso and Honeywell.

Beyond this top 5, this industry welcomes a myriad of companies.

The competitive landscape of the particle sensor industry points out 3 main leading companies: Sharp is still leading in shipments and Plantower is leading in revenue at almost US$20 million.

“The quality of the air we breathe remains a major global issue for the health and safety of people. The World Health Organization links 4.2 million deaths per year to pollution issues and exposure to toxic or dangerous gases. The cost of pollution is also a significant economic impact. The World Bank estimates it to be 4.8% of global GDP” asserts Jérôme Mouly, Team Lead Analyst, Sensing & Actuating at Yole Développement (Yole).

But outdoor pollution is not the only concern today. Growing interest in indoor air monitoring has been amplified by the COVID-19 pandemic. Studies have shown correlations between the presence of exhaled aerosols of micro-droplets and the possible transmission of the virus carried by its aerosols. This fosters the need to control enclosed spaces such as classrooms, offices and public places.

In this context, Yole investigates disruptive technologies and related markets in depth, to point out the latest innovations and underline the business opportunities.

Released today, the Gas and Particle Sensors – Technology and Market Trends 2021 report contributes to identify and analyze the applications and the technologies involved. This study describes the player ecosystem and dynamics. Including market trends and forecasts, supply chain, technology trends, technical insights and analysis, this report also delivers an in-depth understanding of the ecosystem and main players’ strategies.

What are the economic and technological challenges of the gas and particle sensors industry? What are the key drivers? Who are the suppliers to watch, and what innovative technologies are they working on?

Yole presents today its vision of the gas and particle sensors industry.

As analyzed by Yole’s sensing & actuating team, environmental sensors, such as gas sensors and particle sensors, are more and more interesting in areas of indoor air management. In total, gas and particle sensors are expected to be worth US$2.2 billion in 2026, up from US$1.2 billion in 2020, with a CAGR of 10.9%.

For Dimitrios Damianos, PhD, Technology & Market Analyst at Yole: “The very established automotive powertrain, industrial and HVAC markets still dominate, generating around 80% of gas and particle sensor sales. But consumer applications seem finally ready to take off, thanks to the development of smart home and wearables”.

Such products make it possible to monitor both indoor and outdoor air quality, enabling consumers to act according to information measured. This is the market where the biggest momentum is expected, with nearly 40% growth over the period 2020-2026. The development of automotive in-cabin solutions is also an expanding market, showing interest in terms of both comfort and safety.

From selective to non-selective gas detection, consumer and automotive markets are also benefiting from advanced technologies in digital olfaction, mimicking human or animal smell sense using electronic noses to detect odors made of VOCs.

It is the question of usage and use case that has held back the interest of gas and particle sensors in the consumer sector for a long time. The traditional applications of these sensors are mainly linked to regulations at international, national or local levels, as well as security rules in the industrial or defense field. But what are the possible uses for consumers? How can gas and particle sensors help consumers act on the information collected by the sensors? And where does the race towards electrification’s threat to demand in the automotive powertrain sector come in? All of these issues have been studied by Yole and its sensing & actuating team.

The trend for needs of MOS and NDIR technologies is confirmed in domestic applications such as air purifiers, air monitoring stations in smart homes or even in automotive cabins. Gases such as CO2, NOx or VOCs are the main targets for these technologies. The lack of selectivity of MOS technologies and the bulkiness of NDIR sensors has slowed down the adoption of MOS and NDIR based sensors for a long time, but advanced technologies and new applications fostered a higher adoption of these technologies.

According to Jérôme Mouly: “Together, both technologies represent about a quarter of the market share in 2020. We expect this to grow to 41% of global revenues in 2026, thanks to emerging applications and technological advances that are more selective and smaller. MOS and NDIR are expected to decrease the historical market share of electrochemical detectors”.

In the field of particle sensors, a transition has already started concerning optical detection through optical scattering. In particular, this means the use of laser sources instead of LEDs, allowing better measurement of both higher concentration and smaller size particles.

Advanced technologies and emerging usage for gas and particle sensors are paving the way for an exciting momentum with possible mergers and acquisitions, new players in the field and stronger interest for gas and particle applications.

All year long, Yole Développement publishes numerous reports and monitors. In addition, experts realize various key presentations and organize key conferences.

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews.

Stay tuned!

Extracted from:

- Gas and Particle Sensors – Technology and Market Trends 2021 report, Yole Développement

Acronyms:

- CAGR: Compound Annual Growth Rate

- GDP: Gross Domestic Product

- HVAC: Heating, Ventilation and Air Conditioning

- VOC : Volatile Organic Compounds

- MOS: Metal Oxide Semiconductor

- NDIR: Non-Dispersive Infrared