This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

AI features are becoming standard in consumer applications. Yole announces a US$ 5.6 billion market by 2026.

OUTLINE:

-

Market forecasts:

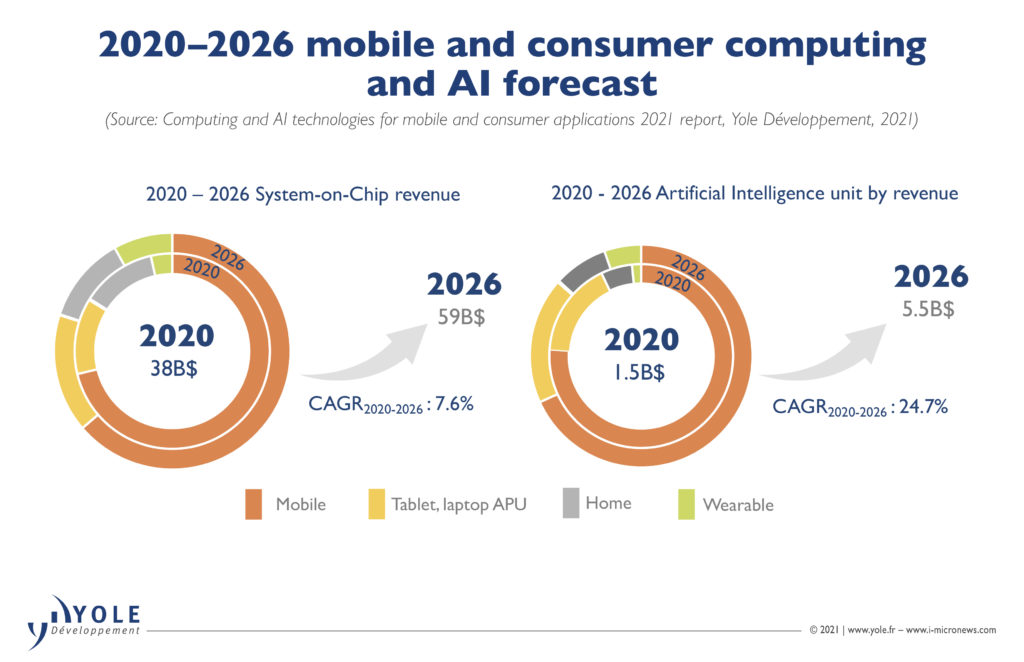

Processor market is showing a 7.6% CAGR between 2020 and 2026, driven by dynamic consumer applications.

AI unit revenue will reach a 24.7% CAGR during the same period, boosted by a strong AI penetration.

Yole Développement (Yole) expects a growth of mobile and consumer SoC shipments, with a 6.8% CAGR2020-2026.

-

Technology trends:

Processors for consumer markets are today mostly SoCs, which are integrating all required functions.

AI inferences are more and more computed at the edge.

Audio AI is today getting integrated into SoC, as an AI unit, following what Yole was seeing for AI imaging in 2019.

-

Supply chain:

Qualcomm and MediaTek are the two biggest processors fabless companies in this domain, both in terms of shipments and revenues.

MediaTek is in a very good for few years, and its strong relationship with the Asian market draws its growth.

Apple is completing the podium: the company is following a different model as they are not selling any processors to anyone, and it is not their objective.

“AI technologies are already in many products that we use every day.” asserts Adrien Sanchez, Technology & Market Analyst, Computing & Software at Yole Développement (Yole). He adds: “They started in our smartphones, through applications such as face recognition or photography setting optimization. They are now spreading into most consumer applications, from smart home cameras with features such as intrusion detection to smart assistant support integrated into earbuds”.

Today imaging and audio are the most widespread AI applications. For several reasons including privacy protection and low latency requirements, AI inference is increasingly computed at the edge of the network, in the actual consumer device. This requires special processor capabilities to run these operations in real time. Share of processors dedicated to run AI is therefore growing.

Yole analyzes today the market and delivers detailed market figures and trends, at both levels, processor and AI unit, including the area of silicon specifically dedicated to accelerating AI operations. The processor market for AI consumer applications should reach more than US$ 59 billion by 2026. At the same time, AI units is showing a US$ 5.5 billion market the same year.

The market research and strategy consulting company, Yole announces today its Computing and AI technologies for mobile and consumer applications 2021 report. With this new technology & market study, analysts deliver a comprehensive understanding of computing trends and dynamics for key mobile and consumer applications. Their aim is to propose a detailed scenario for AI within the dynamics of the consumer market, understand AI’s impact on the semiconductor industry and deliver an in-depth understanding of the ecosystem and players. Yole’s report also points out key technical insight and analysis into future technology trends and challenges.

This report is part of a significant collection of technology & market analyses and monitors. Therefore, Yole investigates MCU and processor markets each quarter and proposes dedicated tools to monitor the evolution of the markets and strategy of key players. Both Processor Quarterly Market Monitor and MCU Quarterly Market Monitor, are published every beginning of March (Q1), June (Q2), September (Q3) and December (Q4)… Aim of these services is to provide an in-depth coverage of rapidly changing market dynamics and main players’ status and strategy.

According to John Lorenz, Technology and Market Analyst, Computing & Software within the Semiconductor, Memory & Computing division at Yole: “The long-term trend within the application processor industry is for OEMs to seek differentiation and demand increasing processing capabilities for end-products, while living within the power and BOM constraints of high mobility. Artificial intelligence enablement, through standalone or embedded AI accelerators, is the newest differentiator for processor designers and OEMs.”

As detailed in the Computing and AI technologies for mobile and consumer applications 2021 report, Yole identified two main families of processor players:

- The one is the smartphone-making OEMs with processor design capabilities, such as Apple, Samsung, Huawei, and soon Google.

- The second group is the fabless processor companies such as Qualcomm, MediaTek, and UniSoC. For John Lorenz: “Qualcomm and MediaTek are the two biggest fabless processor companies for consumer applications, both in terms of shipments and revenues. They have products targeting most consumer applications, with either one or the other usually being the leading player”.

Apple follows a specific model, however. It is the third-placed processor maker for consumer markets but doesn’t sell processors to anyone. Processors let Apple control its ecosystem and to adapt its products’ hardware to its software. Even if Apple’s silicon design activity is just to support its products, it designs top-level processors and frequently drives innovation in this domain.

Following a similar strategy, HiSilicon, a Huawei subsidiary, was very dynamic in 2020, following the strong growth of Huawei products. However, following the application of US sanctions, the story will be totally different. Yole expects HiSilicon to lose almost half of its APU revenue in 2021. In the short term, the future of high-end HiSilicon products made technology beyond the 14nm lithography node is uncertain.

According to Adrien Sanchez: “Smartphone processor designers also lead the race in most other consumer product processor markets. That is especially true in smartwatches which has the same players, both for end-products and processor. For TWS earbuds, the story is different. Big processor players compete with historical processor players specialized in Bluetooth and audio technologies, but also with new players, mainly from China”.

For example, BES Technic has leveraged the sky-rocketing growth of TWS earbuds to become a major player in this market. Smart speaker makers are also different from big smartphone players. They are US and Chinese tech giants, through partnerships with processor players. For example, Amazon and MediaTek make a processor that integrates Amazon’s custom AZ1 Neural Edge processor. Other players include Synaptics, Amlogic, and Allwinner Technologies. All the big players, and US and Chinese tech giants especially, are very involved in acquisitions of and investment into AI start-ups. This entire dynamic ecosystem is analyzed in detail in this report, including a broad analysis but also specific focuses on wearables and smart homes.

All year long, Yole Développement publishes an impressive collection of computing-dedicated reports and monitors. Experts also realize various key presentations, organize key conferences and interview leading industrial companies. Their aim is to deliver key results and technology and market trends and explain the major changes.

In this regard, do not miss the webinar on Tuesday 16, November 2021: Neuromorphic Sensing and Computing: Compelling Options for a Host of AI Applications. Register on i-Micronews !

Make sure to be aware of the latest news coming from the industry and get an overview of our activities on i-Micronews. Stay tuned!

Extracted from:

- Computing and AI technologies for mobile and consumer applications report, Yole Développement, 2021

Acronyms:

- CAGR: Compound Annual Growth Rate

- AI: Artificial Intelligence

- SoC: System-on-Chip

- MCU: Microcontroller

- OEM: Original Equipment Manufacturer

- APU: Application Processor Unit

- TWS: True Wireless Stereo