This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

OUTLINE:

-

Market forecasts:

The consumer IMU market is expected to reach US$838 million in 2026.

According to Yole Développement (Yole), the CAGR between 2019 and 2026 will be 5%.

-

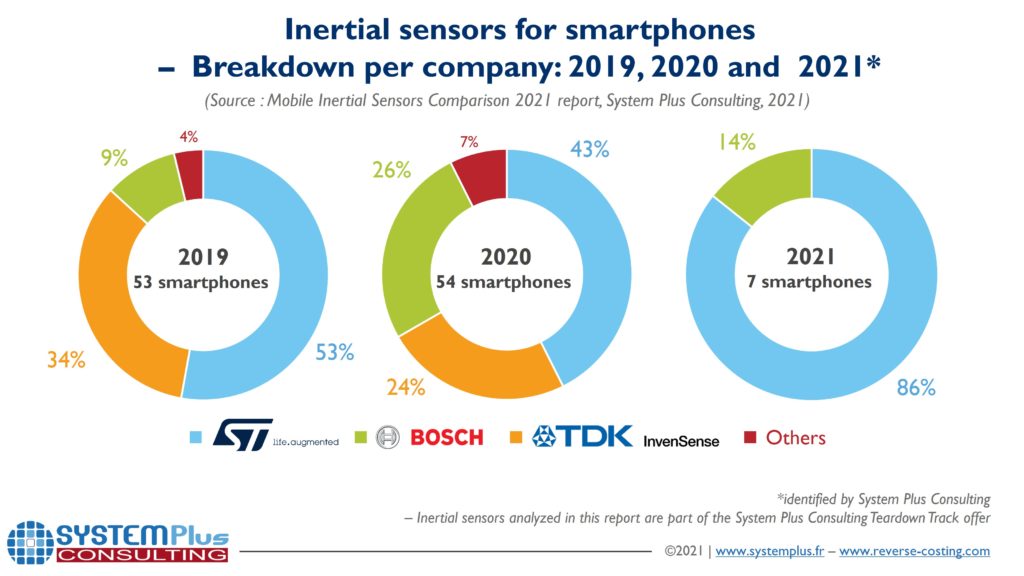

Based on System Plus Consulting’s sample of 54 smartphones in 2020:

STMicroelectronics is the leader in IMUs integrated into smartphones, with 43% of the total smartphone opened.

Bosch and Invensense follow, with 22% respectively.

These top three manufacturers use different processes and have their own strategies.

“The MEMS inertial sensor market focused on IMUs in smartphones is mainly represented by three leading MEMS device manufacturers: STMicroelectronics, TDK InvenSense, and Bosch Sensortec.” asserts Audrey Lahrach, Technology & Cost Analyst, MEMS, Sensors & Displays at System Plus Consulting. She adds: “Those players have made different technological choices in an ultra-competitive sector to reach their own objectives. As an example, we identified different wafer assembly processes such as glass frit, eutectic bonding combined, or not, with fusion bonding”.

Yole Développement (Yole) has been investigating the MEMS industry for a while and collaborates closely with System Plus Consulting to analyze the growth of the MEMS market, the strategies of the MEMS companies, and the evolution of the technologies. In its dedicated MEMS report, Status of the MEMS Industry 2021, the market research & strategy consulting company forecasts a US$838 million consumer IMU market in 2026 with a 5% CAGR2020-2026.

Audrey Lahrach from System Plus Consulting comments: “This growth will be driven by an increasing integration rate of MEMS IMUs in smartphones & wearables. Moreover, the increasing replacement of stand-alone MEMS accelerometers and gyroscopes with IMUs will contribute to this growth.”

In this dynamic context, the reverse engineering and costing company System Plus Consulting, part of the Yole Group of Companies, releases today a comprehensive analysis fully dedicated to inertial sensors for smartphone applications: the Mobile Inertial Sensors Comparison 2021 report. For this report, System Plus Consulting looked at a sample of 114 smartphones. It extracted the MEMS inertial sensors from each smartphone and analyzed each IMU found in-depth. The sample included 53 smartphones released in 2019, 54 smartphones in 2020, and 7 in 2021. With this approach, System Plus Consulting’s analysts identified the reference of each sensor for each smartphone and, underlying that, the devices’ manufacturer.

With this new report, System Plus Consulting delivers a comparative review of the most common IMU references for smartphones. The company examined the dimensions and internal structures of their packages, MEMS arrays, and ASICs , as well as their die sizes and cross-sections of the packages. Its objective is to present a comprehensive review of MEMS inertial sensors in smartphones, the technical choices made by each MEMS device manufacturer, and make the link with the relevant OEMs.

The comparison has been further developed at the IMU manufacturing process level between manufacturers, as well as between the different technologies selected by the same manufacturer and integrated into the smartphones comprising System Plus Consulting’s sample. Lastly, a comprehensive technology and cost analysis is presented of the most common references found in our sample, including the MEMS, the ASIC, and the packaging.

In addition, this report features a teardown analysis with a package opening and a MEMS die opening for the components that integrate single MEMS (only a gyroscope or an accelerometer).

System Plus Consulting’s sample also reveals that STMicroelectronics is the design wins’ with 3 main different references and is the leading MEMS device manufacturer with half of the total components. TDK InvenSense and Bosch Sensortec occupy the second and third places, with 27% and 17%, respectively.

To conclude, these top 3 companies manufactured 94% of the total components integrated into the smartphone sample analyzed by System Plus Consulting since 2019.

The most important observation in System Plus Consulting’s report is MEMS die size reduction for STMicroelectronics in their LSM6DSO reference, states Audrey Lahrach from System Plus Consulting.

For TDK Invensense, many things have changed. Therefore, System Plus Consulting highlights in its report the significant evolution in the processing of its ASIC part. The MEMS device manufacturer has reduced its technological node by switching to 90nm in its last reference and integrating layers of copper metal while keeping aluminum for the eutectic wafer bonding Al-Ge. Thus, the company assembles the ASIC and the MEMS at the wafer level to get a single ASIC/MEMS die.

From their sides, the two companies, STMicroelectronics and Bosch Sensortec, decided to combine their two dies in their LGA Package, the ASIC on one side and the MEMS on the other. Bosch Sensortec placed its gyroscope and its accelerometer on the same chip in one reference, BMI270. It aimed to remove one die in the component, which impacted the size of the MEMS chip, at the same time, compared to its previous one…Further details in the Mobile Inertial Sensors Comparison 2021 report.

Throughout the year, Yole Group of Companies, including System Plus Consulting and Yole Développement, publishes numerous sensing-dedicated reports. In addition, experts realize various key MEMS-dedicated presentations and organize key conferences.

Do not miss Semicon Japan 2021 from Wednesday 15 December to Friday 17 December 2021, in Tokyo, Japan, and online. Dimitrios Damianos, Senior Technology & Market Analyst at Yole Développement, will participate in “MEMS & sensor trends: exciting upcoming opportunities and points of vigilance”. Register now on i-Micronews!

In addition, take part in the MEMS World Summit China 2021, from October 19 to 20, 2021, online. Jérôme Mouly, Team Lead Analyst, Sensing & Actuating at Yole will participate in “Gas Sensor Evolution and the Need for Better Air Quality Monitoring”. Register here!

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews. Stay tuned!

Extracted from:

- Mobile Inertial Sensors Comparison 2021, System Plus Consulting, 2021

- Status of the MEMS Industry 2021, Yole Développement, 2021

Acronyms:

- IMU: MEMS consumer inertial measurement unit

- CAGR: Compound Annual Growth Rate

- ASIC: Application-Specific Integrated Circuits

- OEM: Original Equipment Manufacturer