This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

After the boom in thermal cameras used for fever detection in 2020, Yole Développement analyzes the evolution of this industry and identifies the next steps, especially the role of the Chinese companies.

OUTLINE:

-

Thermal camera market evolution:

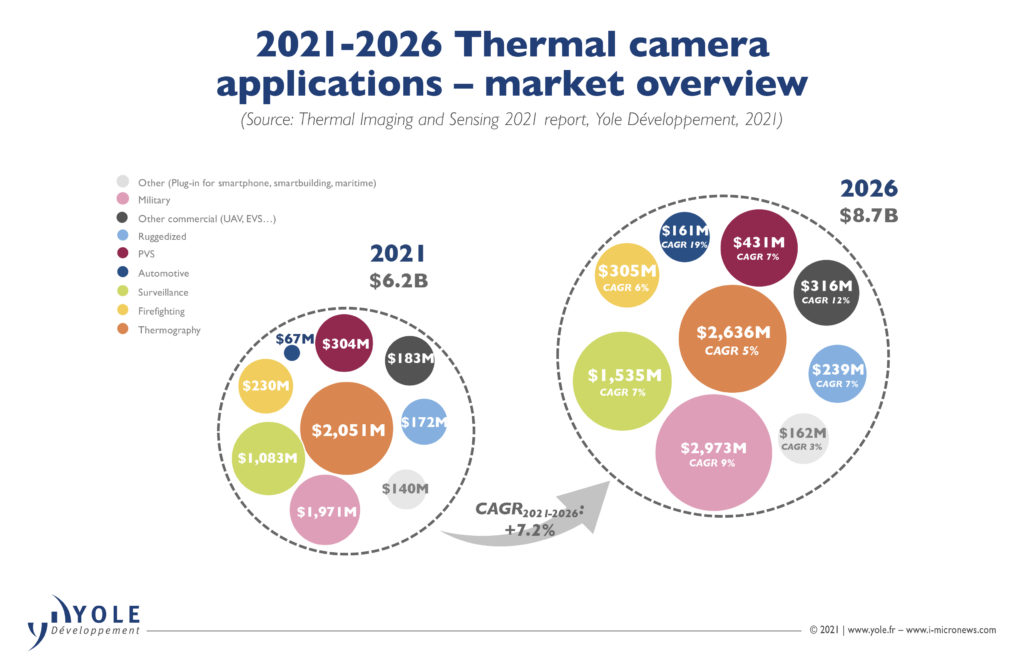

It is expected to grow to US$8.7 billion by 2026 at a 7.2% CAGR 2021-2026.

In 2021, compared to 2020, the market will decrease a bit due to the drop in EBT/EST camera shipments.

But this drop could be compensated for in the following years.

Thermography & surveillance will remain the biggest segments in the civil market.

-

Technology trends:

Major trends for thermal detectors: size & cost reduction, low power consumption for good battery operation…

For thermal cameras, the market sees an evolution of FPA ’s to higher resolutions.

An emerging trend is the combination of cameras and advanced processing to use them as sensors.

-

Supply chain:

Thermal detector: competition is very fierce, with many Asian players profiting in 2020 from the COVID-19 pandemic.

Now, Asian companies, including Senba, Orisystec, etc., have already started developing digital & smart sensors along with intelligent software and embedded algorithms.

Western thermal imager players, including FLIR, Lynred, Seek Thermal, for example, are returning to traditional applications mainly.

Chinese companies such as GuideIR, IRay, Hikvision, and Dali are pushing the adoption of their thermal imagers, with existing strong sales channels, mainly in traditional surveillance (CCTV).

“In 2020, thermal imaging and sensing took center stage in the fight against COVID-19”, explains Dimitrios Damianos, Ph.D., Senior Technology & Market Analyst, part of the Photonics & Sensing division at Yole Développement (Yole). He adds: “After an EBT/ EST camera sales gold-rush for a great many manufacturers, the demand finally fell in late 2020 and is returning to normal through 2021.”

The overall thermal imaging market is expected to decrease from US$6.6 billion in 2020 to US$6.2 billion in 2021, settling at a higher revenue point than pre-pandemic levels. However, a 7.2% CAGR from 2021 to 2026 could make the market climb to US$8.8 billion…

The market research & strategy consulting company, Yole, releases today the Thermal Imaging & Sensing 2021 report. As an updated version of the “Thermal Imaging/Sensing” series of annual reports, the 2021 edition provides updated volumes, market values, market shares, and associated forecasts for thermal imagers and detectors. This year, the focus is on the return of some normality to the thermal imaging and sensing market, back to more traditional applications after the unprecedented year 2020.

Yole’s investigations have been supported by the collaboration with both partners, System Plus Consulting and Piséo. These companies have collaborated with Yole for a while. Together they combine their expertise to deliver valuable and comprehensive analyses to their customers. Piséo has released, for example, two dedicated reports this year, entirely dedicated to the performance analysis of thermal imaging systems: FLIR Boson Thermal Camera Performance Analysis and iRAY T3S Thermal Camera Performance Analysis.

Although the decreasing sales of EBT/EST applications pulled down the commercial market, the massive exposure of everyday people to thermal imaging technology is driving a significant increase in demand for traditional thermal camera applications, such as thermography, surveillance, firefighting, ruggedized phones, other commercial uses, and personal vision systems, which compensate for the fall in EBT/EST. These applications benefit from both the economy’s rebound in 2021 and the end of repeated shutdowns which drove the high demand for both professional and recreative uses. COVID-19 did not really impact the military thermal imaging market as many countries did not cut their military budgets.

“The market grew between 2019 and 2021, but its dynamics have returned to a more normal situation as no new significant segments emerged,” asserts Axel Clouet, Ph.D., Technology & Market Analyst at Yole. “Thermal imaging thrives in an educated market but still struggles to enter the smart building, automotive, and consumer markets, which could drive high volumes.”

The smart building segment demands very low prices, and there is competition with low-resolution thermal detectors (thermopile arrays).

A promising use of thermal imaging in automotive is in ADAS to trigger autonomous emergency braking in all conditions. However, this technology still requires development to meet automotive reliability and performance requirements at an acceptable cost level.

Finally, while the killer app for thermal imaging in the consumer market might not have been found yet, the market is at the early stages of new developments. After acquiring Metaio in 2015 and getting access to its Thermal Touch technology, Apple released a patent in 2021 showing a new use case for thermal imaging as a user interface for AR applications. But how far along is the consumer (r)evolution in the thermal imaging/sensing market?

In its 2021 thermal imaging & sensing report, Yole’s team deeply investigates the competitive landscape, especially the evolution of the Chinese players that have chipped away market share from traditional players. Today, they are stabilizing, explains Yole in this market & technology analysis.

Dimitrios Damianos from Yole asserts: “In 2020, Chinese thermal imager manufacturers supplied thermal imagers massively, mainly due to the EBT/EST applications, and more than doubled their shipment market share in going from 18% in 2019 to 39% in 2020.”

The market had grown significantly YoY19-20, with every Chinese player stabilizing their volume market share. Chinese players reaped more fruit due to their technology ramp-up in the last few years in conjunction with the strong appetite for fever detection cameras, especially in the domestic market, which was more widely accepted than in western countries…

However, what could happen in the future? Will Chinese players keep chipping away at other players’ market shares while the whole market grows? Or will the market stabilize at a new normal retaining the players’ relative market shares, everyone profiting from an increasing pie?… Yole deep dives into the thermal imaging and sensing industry to give you a valuable and comprehensive overview of the ever-evolving landscape.

Throughout the year, the Yole Group of Companies, including System Plus Consulting, Piséo, and Yole Développement, publishes numerous imaging-dedicated reports. In addition, experts realize various presentations and organize key conferences.

Do not miss the presentation of Dimitrios Damianos, Ph.D., Senior Technology & Market Analyst, part of the Photonics & Sensing division at Yole, presented last September at the CIOE conference, entitled: “After an eventful 2020, what’s coming next for the thermal imaging and sensing market?”. Discover it on the Sensing section on i-Micronews’ presentations.

Make sure to discover the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews. Stay tuned!

Extracted from:

- Thermal Imaging & Sensing 2021 report, Yole Développement, 2021

Acronyms:

- CAGR: Compound Annual Growth Rate

- FPA: Focal Plane Array

- CCTV: Closed-circuit television

- EBT/ EST: Elevated Body/Surface Temperature

- ADAS: Advanced Driver-Assistance Systems

- AR: Augmented Reality