This market research report was originally published at Woodside Capital Partners’ website. It is reprinted here with the permission of Woodside Capital Partners.

Woodside Capital Partners (WCP) is pleased to share our Industry Report on the AI Semiconductor Market 2021, authored by Managing Director Shusaku Sumida.

This report covers the following aspects of the Semiconductor Market:

- Market Update Summary

- Supply and Demand Dynamics

- Continued Consolidation

- Thoughts on the Future of the Industry

- AI Semiconductor Startups

- Market Classification of AI Semiconductors

- Status of AI Semiconductor Startups

Invested AI Semiconductor Startups

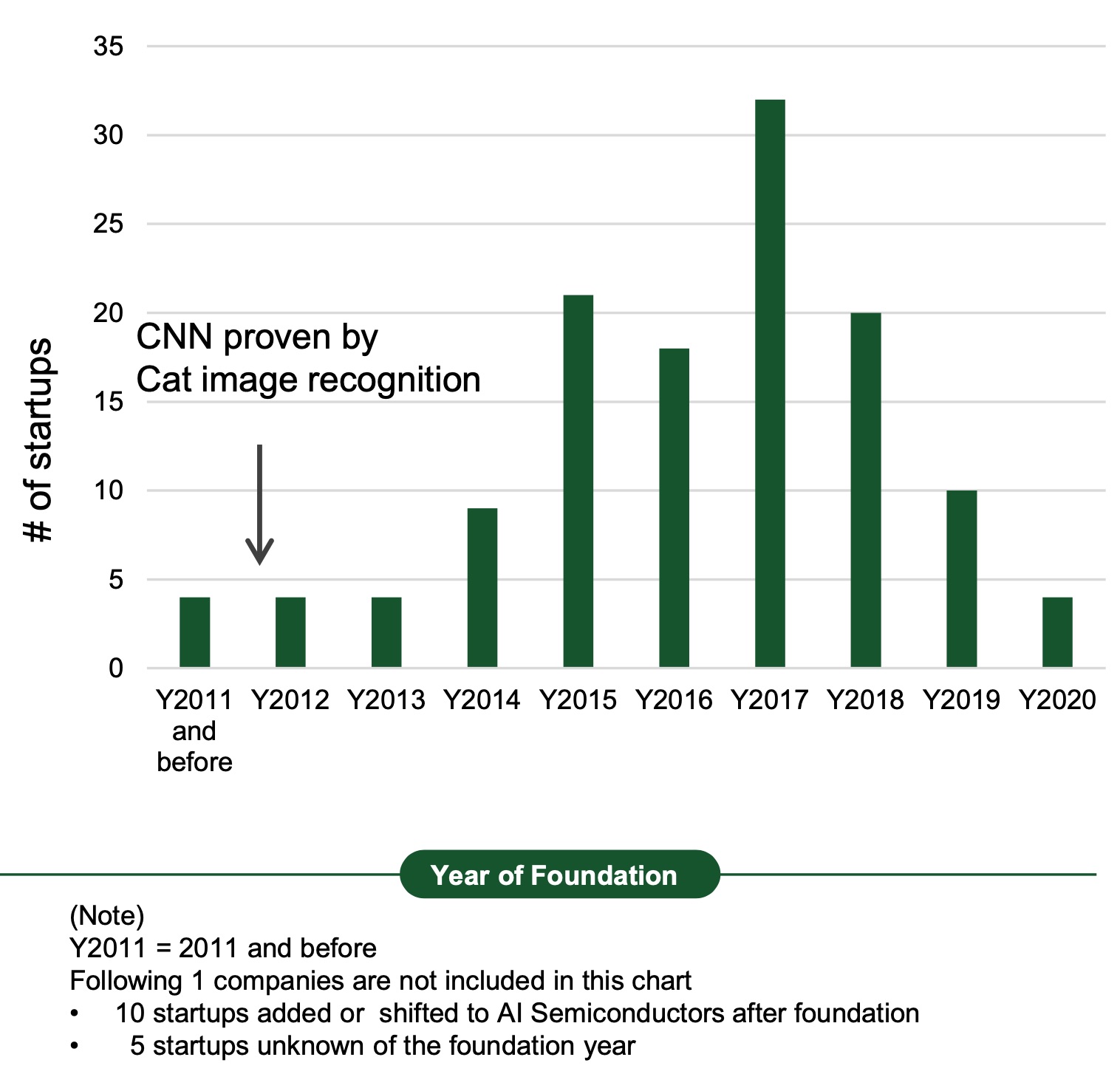

The effort to integrate AI functions as well as learning functions into semiconductor devices was first attempted in the years before 2010. However, those efforts were not successfully achieved.

Seeing the progress of CNN technology, interest in AI semiconductors expanded dramatically. Some of the existing startups also expanded to cover AI functions.

151 funded AI semiconductor startups are identified as of December 21, 2021.

Current status (as of December 31, 2021):

- 126 active startups

- 5 IPO/reverse merger

- 9 acquired

- 11 out of business

We anticipate more startup companies will be funded in the future. A similar situation happened in the early 90’s, when the Internet was taking over conventional communication technology.

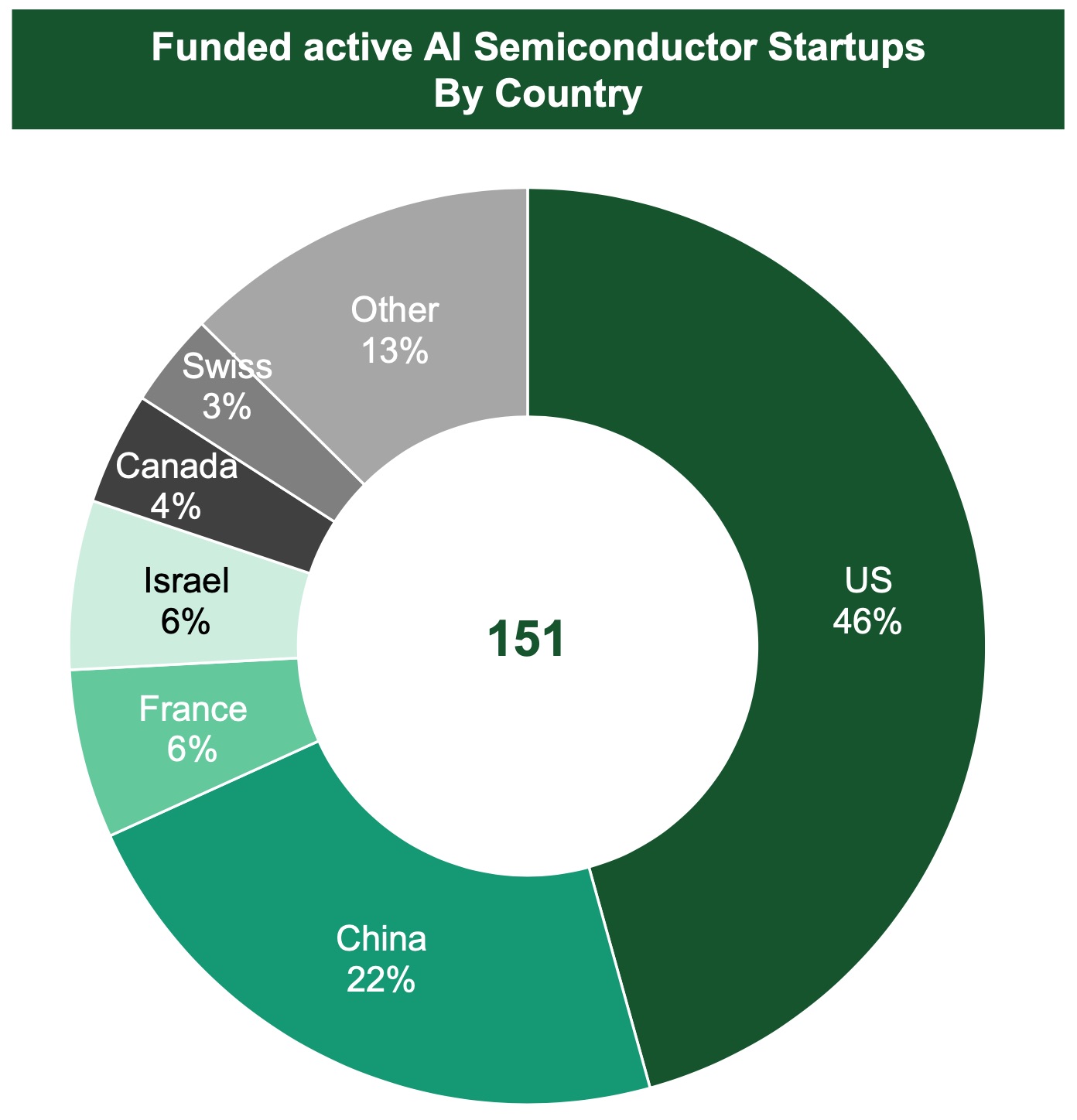

AI Semiconductors – Startup by Country

Current status (as of December 31, 2021):

- 10 added AI capabilities on the top of the initial products

- 11 are out of business

- 9 were acquired

- 5 made an IPO/reverse merger

- 125 are active as startups

As usual, Silicon Valley is, since the early 2000s, creating many AI semiconductor startups, and the US has 69, 46% of the total global number of AI semiconductor startups.

China is following the US, with 34 startups.

As of Dec. 2021, we count 13 unicorn companies.

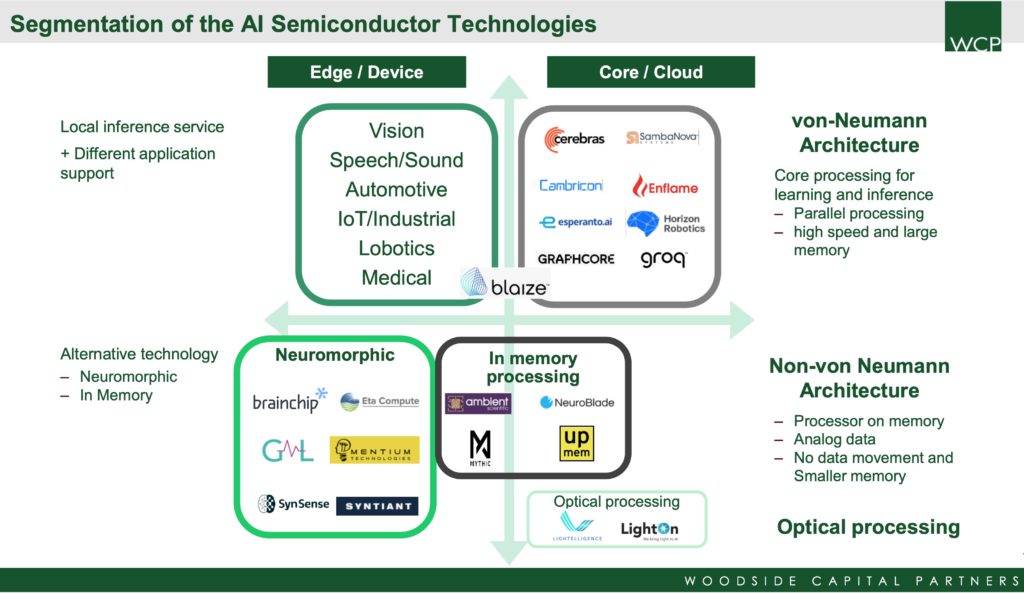

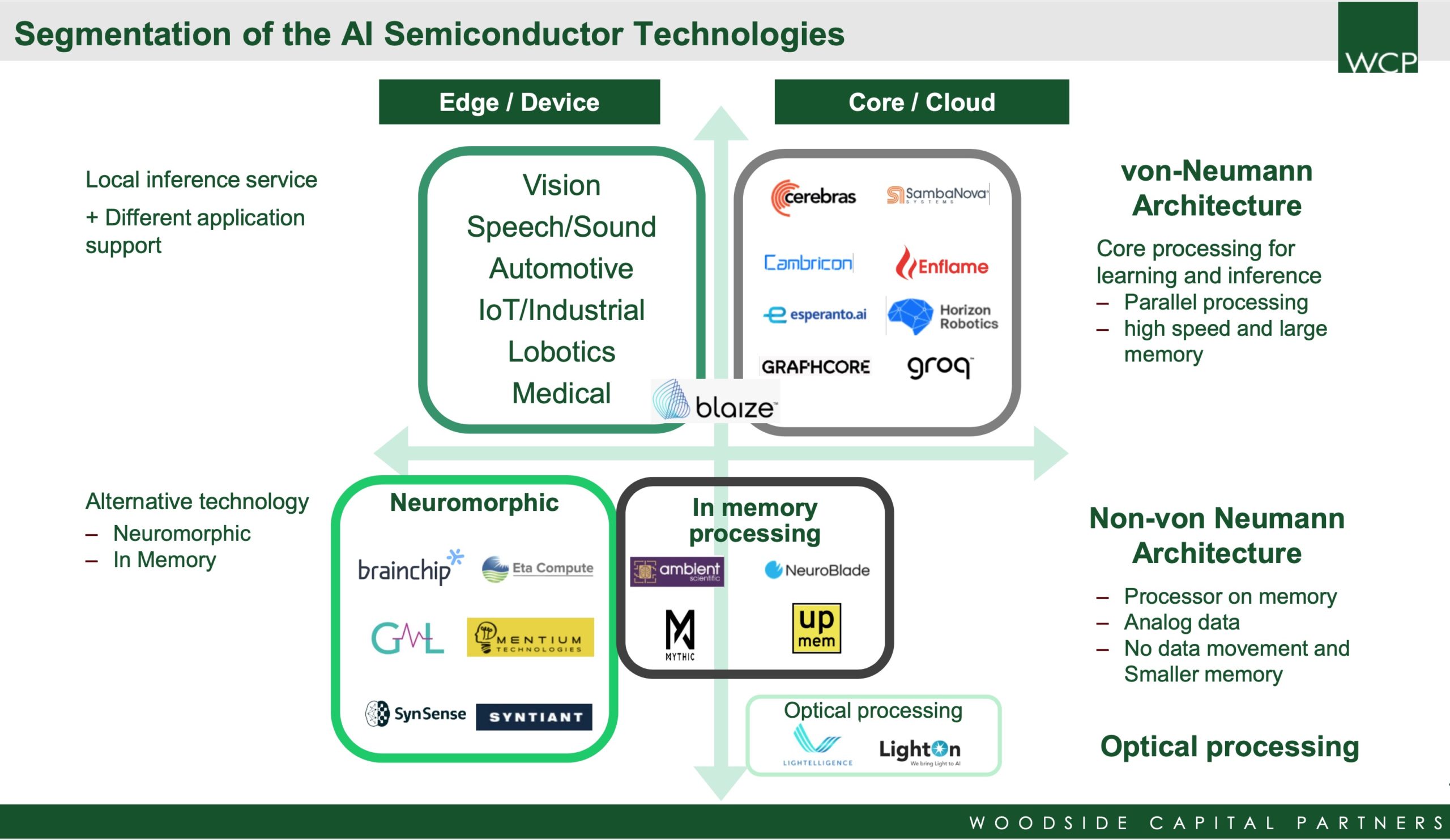

Segmentation of AI Semiconductor Technologies

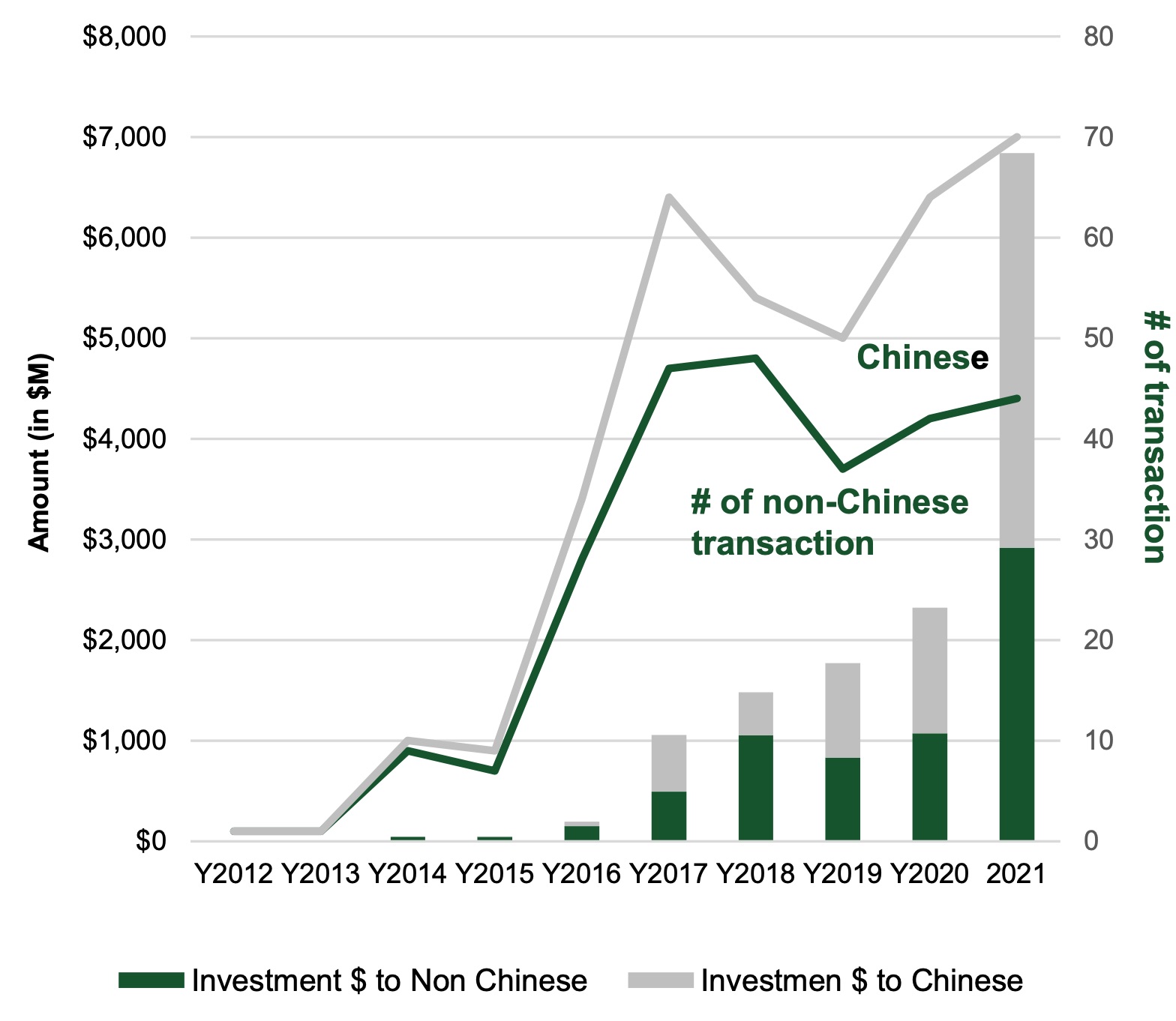

Investment in AI Semiconductor Startups

- The total invested money in AI semiconductor startup companies for the last 10 years is $13.8B from 710 investors (as far as the information is disclosed and available).

- Interest in AI semiconductors has been strong and growing rapidly since 2016, and capital investment in startups quickly exceeded $1.6B for 65 companies in 2018.

- Investment activities slowed down in 2019 but recovered in 2021 and became more aggressive but very selective.

- A huge amount of money is invested in the selected companies, mostly to date in core processors for the cloud.

- Investment in China began in 2015 and has been very active since then. The investment amount in Chinese startups in 2021 exceeded $3.6B, 55% of the global investment of the year.

- Some of the transactions in China do not disclose the value.

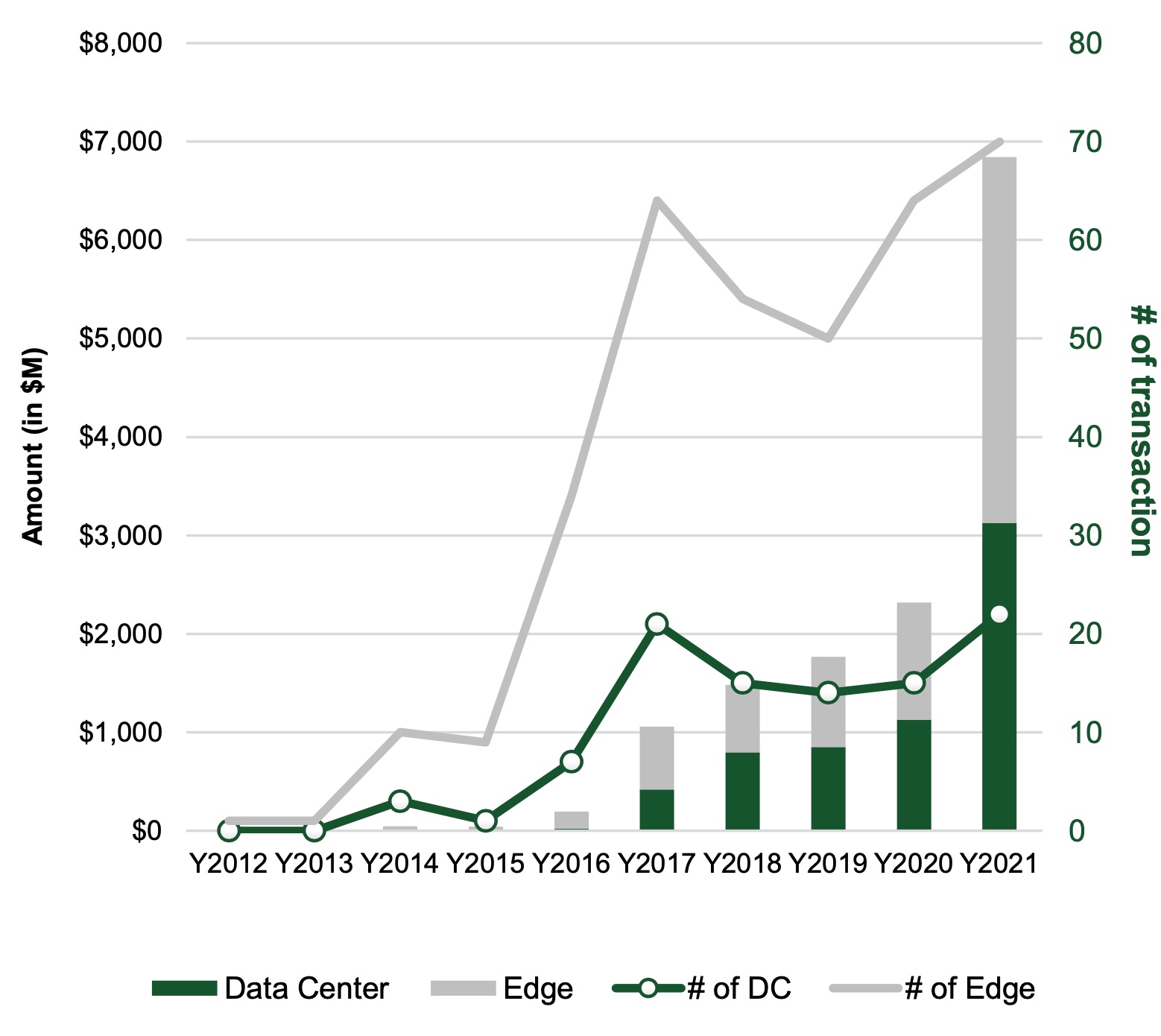

Investment by Application

- To date, the invested amount to edge AI devices and to AI processors for the data center is around the same level.

- However, the number of startup companies in edge AI that received investment is 2X that of those for the data center.

- This means that the average investment made to data center AI processors is more than 2X of the average investment made to edge AI devices.

- AI processors for the data center require much higher performance and functionality versus edge AI processors. A finer-pitch manufacturing process is required, for example. More generally, the NRE for core processors is more expensive.

About the Author

Shusaku Sumida joined WCP in 2010 and is FINRA-licensed and registered, Series 79 & 63.

He has over 30 years of global experience in engineering, sales & marketing, operation, strategic planning, and management in the Semiconductor industry, including experience in Japan, Hong Kong, and the USA.

He founded Oki’s Hong Kong operation, founded Silicon Dynamics, a Networking LSI development group under Oki Semiconductor, and ran Oki Semiconductor USA, a $300M operation which included sales, marketing, design center, and R&D.

He served as a Technology Advisory Board member of the Pittsburg Digital Greenhouse (2001-2005) and also participated in the founding of the startups of Silicon Clocks, Passif Semiconductor, and eStat.

He is a visiting lecturer on Growth Strategy of Startups at BBT Kenichi Ohmae School of Business and is an advisory board member of Nagoya University’s DII DR Program.

He received a BE in Material Science from Kyoto University in Japan.

About Woodside Capital Partners

Woodside Capital Partners is the leading corporate finance advisory firm for tech companies in M&A and financings in the $30M-$500M segment. The firm has worked with the best entrepreneurs and investors since 2001, providing ultra- personalized service to select clients. Our team has global vision and reach, and has completed hundreds of successful engagements. We have deep industry knowledge and extensive domain experience in the following sectors: Autonomous Vehicles and ADAS, Computer Vision, Artificial Intelligence, Cloud/Enterprise Software, Cybersecurity, Digital Entertainment & Lifestyle, Health Tech, Internet of Things, Marketing Technology, Networking / Infrastructure, and Robotics. Woodside Capital Partners is a specialist in cross-border transactions, with extensive relationships among venture capitalists, private equity investors, and corporate executives from global 1000 companies. More about Woodside Capital Partners here.

The remainder of Woodside Capital Partner’s report can be found here.