Source: Yole Group (EE Times Europe, 2025).

In a bold move, STMicroelectronics is betting nearly $1 billion on tiny sensors. The European chipmaker’s recent deal to acquire NXP Semiconductors’ MEMS sensor business for $950 million is turning heads. After all, the Micro Electromechanical Systems (MEMS) market has long been seen as mature – even a bit stodgy – with single-digit growth. So, what does ST know that others don’t? The answer: MEMS technology is quietly becoming a strategic battleground again, driven by new demand in cars, IoT, and beyond. As Simone Ferri of ST puts it, advanced MEMS enable “safety, electrification, automation, and connected vehicles”, and automotive inertial sensors are set to outpace the overall ~4% CAGR MEMS market growth. In other words, these microscopic machines are key to macro-scale trends, and investors should take note.

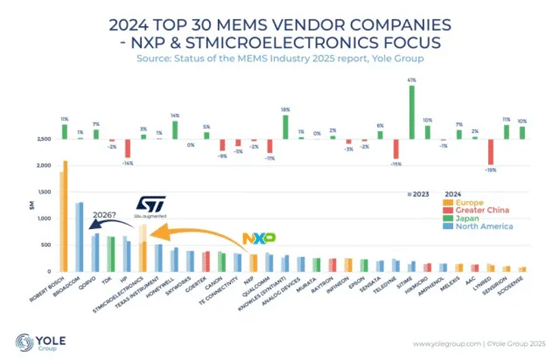

Big Players Double Down on Sensors

The MEMS industry’s giants are entrenched; but that isn’t stopping them from shaking things up. Bosch, STMicroelectronics, and TDK already lead the MEMS sensor market, collectively shipping billions of accelerometers, gyros, and microphones each year. Yet even these incumbents are seeking an edge. ST’s grab for NXP’s sensor unit is a play to put pressure on its competitors and move to the top of MEMS vendors ranking. Bosch remains #1 with about $2 billion in MEMS revenue for 2024, while ST was a distant sixth and NXP sat at 13th. By absorbing NXP’s ~$300 million MEMS business, ST aims to catapult itself into a stronger position in automotive safety sensors: from airbags to tire-pressure monitors.

This consolidation trend reflects a business model shift in a stabilizing industry. The main MEMS markets (smartphones, cars, and industrial) are well-served by the big three, so growth now comes from strategic shifts: acquisitions, partnerships, and refocusing. Notably, NXP had already been using ST as a foundry for its MEMS chips. Essentially, NXP’s exit became ST’s opportunity – a fast-track to bolster its automotive portfolio without overlapping with ST’s existing consumer sensor lineup. For NXP, shedding MEMS presumably frees it to double down on its core (MCUs, radar, etc.), whereas for ST, it’s a chance to rebalance towards high-growth automotive applications. This kind of deal underscores that even in a seemingly mature market, bold bets and consolidation can unlock value.

Chasing the Next MEMS Breakthrough

The scramble isn’t just about scale; it’s about the next big thing. Classic MEMS devices (motion sensors, pressure sensors, microphones) have become cheap commodities, shipped by the billions for phones and cars. Now the industry is in a transitional phase, searching for its next blockbuster. Will the next billion-dollar MEMS product be in autonomous vehicles’ lidar sensors, biomedical micro-implants, or human-machine interfaces? Or perhaps ultra-miniature speakers for the latest earbuds and AR glasses? The possibilities are wide open, and no one is sure which will hit big. Even Professor Hiroshi Ishiguro, the renowned robotics pioneer, points to humanoid avatars as a future driver of demand, where MEMS sensors enable human-like perception and interaction; an idea he will expand on in his upcoming keynote at SEMICON Taiwan this September. This uncertainty is exactly what makes MEMS exciting again – and risky. For those with vision, it’s a chance to define a new category.

Several trends are reshaping the future of MEMS. One is the rise of piezoelectric MEMS, using thin films like PZT to enable more powerful and efficient actuators and sensors. According to Yole Group, PiezoMEMS could make up 30% of all MEMS wafers by 2029: a major shift from legacy capacitive designs. New materials and foundry capabilities available since 2018 have unlocked previously unviable applications, from solid-state speakers to precision inkjet heads.

Another key trend is sensor integration. The market now demands more than standalone MEMS chips. Value lies in bundling sensors with ASICs, embedded AI, and software. Leading firms like Bosch and ST to offer full-stack sensor solutions, and startups are following suit. Advances in 3D heterogeneous integration are also enabling tighter packaging and higher performance. Meanwhile, photonics-MEMS fusion is emerging, enabling breakthroughs in LiDAR, optical switching, and precision sensing beyond traditional electrical limits.

Edge AI is another driver, turning basic sensors into multi-modal, context-aware systems. Consider a multi-mode sensor that alerts only when it detects heat, smoke, and a specific vibration signature. These smarter, adaptive devices unlock entirely new use cases.

These innovations align with urgent market needs: advanced automotive sensing, AR wearables, environmental monitoring, and sustainability. With the post-pandemic slowdown behind us, 2024 marked a turning point. As growth resumes in 2025, the MEMS sector, once seen as mature, is entering a renewed innovation cycle, offering compelling opportunities for investors.

Investors Are Paying Attention (Finally)

Not long ago, venture capitalists were notoriously shy about semiconductor hardware startups, including those in sensors. That’s been changing. There are hundreds of MEMS-related startups globally – from Silicon Valley to Shenzhen – and many are getting funded by both traditional VCs and corporate investors. In 2023–2025 we’ve seen a steady flow of eight-figure funding rounds into MEMS companies, and even a few nine-figure exits. Big industry players are also opening their wallets to nurture sensor innovation. For instance, Bosch just announced a new $270 million venture fund aimed at deep-tech startups. In other words, smart money sees long-term opportunity in core technologies like sensors, irrespective of short-term cycles.

Corporate strategic moves also highlight the value being placed on MEMS tech. A striking example: Syntiant, a young AI chip startup, recently acquired Knowles Corporation’s Consumer MEMS Microphone division. Knowles was a pioneer in MEMS mics (the tiny microphone in your smartphone likely came from them), yet a startup specializing in edge AI decided owning the sensor technology was worth it. This kind of deal underscores how boundaries between semiconductors and sensors are blurring. AI processing companies want sensor hardware; sensor companies add AI to their chips. The end goal is delivering smarter, turnkey solutions; and it’s driving M&A in both directions.

Meanwhile, the exit landscape for MEMS startups has improved. InvenSense – once a venture-backed MEMS gyro supplier – was bought by TDK for $1.3 billion a few years ago, validating that a small company with the right tech can command big valuations. More recently, STMicro has shown willingness to partner with or absorb smaller players (beyond the NXP deal). ST has run “lab-in-fab” programs, hosting startups like USound (an audio MEMS maker) and Chirp Microsystems (ultrasonic sensors) in its fabs to help bring their products to market. Such collaborations often foreshadow acquisition or at least long-term supply deals.

It’s also worth noting the geographic broadening of MEMS innovation. The United States, China, and Germany lead in number of MEMS startups, but significant activity is happening in the UK, France, Israel, Japan, and more. Government initiatives to boost domestic semiconductor tech (in the US and Europe) include sensors as a key area, potentially funneling grants or incentives to MEMS fabs and design houses. For investors, a global scope is important; the next great MEMS idea might come from a university spin-off in Bristol or a garage lab in Bangalore.

All told, the MEMS sector has the ingredients venture investors love: a stable base of revenue (ensuring the floor won’t fall out), under-appreciated new markets on the horizon, some clear technology inflection points, and the potential for strategic buyouts by cash-rich industry leaders. It’s a classic “picks and shovels” play too: as trends like AI, autonomous vehicles, and IoT proliferate, they cannot happen without sensors. As Eric Aguilar, co-founder and CEO of Omnitron Sensors eloquently said, “MEMS sensors are the intelligent microscale devices that allow us to touch the world through silicon. In an increasingly connected and automated world, that “touch” is invaluable.

Startups to Watch in MEMS

Finally, no outlook would be complete without a watchlist of promising startups pushing the MEMS frontier. Here are six young companies – across different domains and geographies – that exemplify why the MEMS sector is buzzing again:

- Zero Point Motion (UK): Developing ultra-precise motion sensors by fusing silicon photonics with MEMS. The startup recently raised $8.81 million to accelerate development.

- UltraSense Systems (USA): Pioneering solid-state touch interfaces by integrating MEMS ultrasound, custom silicon, and AI. Backed by over $70M in funding, UltraSense is already working with leading OEMs to bring buttonless control to production.

- Omnitron Sensors (USA): Omnitron has developed new fabrication IP enabling the mass production of MEMS devices that were previously too costly or unreliable. The company secured a $15.5 million Series A to scale its operations and is pioneering Optical Circuit Switch (OCS) technology that delivers unprecedented performance, scalability, and reliability for next-generation data center and AI network architectures.

- xMEMS Labs (USA): The pioneer of MEMS micro-speakers, xMEMS is replacing traditional audio drivers with silicon chips. The startup has raised almost $80 million and recently won industry awards as MEMS “Startup of the Year” for its innovations.

- Blickfeld (Germany): A Munich-based LiDAR sensor startup that’s making waves in mobility and IoT. Blickfeld has raised about $70 million to date and already launched a production product: the Qb2 smart LiDAR.

- NevadaNano (USA): A sensor startup at the intersection of cleantech and IoT, NevadaNano produces MEMS-based gas sensors and monitoring software, targeting the global need for emissions tracking. The company closed a $30 million Series C in 2023 led by strategic investors Honeywell and Emerson.

Each of these startups illustrates a facet of why the MEMS sector is a sector to watch. Whether it’s enabling new mega-markets (autonomous vehicles, AR wearables), leveraging novel materials (photonic and piezoelectric MEMS), or riding societal trends (clean energy and climate monitoring), the MEMS innovators are punching above their micron-scale weight. For industry executives, keeping an eye on these newcomers could spark partnership or acquisition opportunities. For tech investors, backing the right MEMS horse could mean a stake in the next indispensable hardware platform – the kind that scales to billions of units and underpins entire ecosystems. In an era obsessed with software and AI, it’s refreshingly edgy to say: “Don’t forget the sensors.” The MEMS market may not grab headlines often, but it’s precisely this under-the-radar status that offers savvy investors a chance to get in early on the quiet revolution happening at the microscale.

George Jones

Managing Director, Woodside Capital Partners

Alain Bismuth

Managing Director, Woodside Capital Partners

Alex Bonilla

Analyst, Woodside Capital Partners

Woodside Capital Partners is one of the leading corporate finance advisory firms for tech companies in M&A and financings in the $30M –$500M segment. The firm has worked with some of the best entrepreneurs and investors since 2001, providing ultra-personalized service to select clients. Our team has global vision and reach, and has completed hundreds of successful engagements. We have deep industry knowledge and extensive domain experience in the following sectors: Autonomous Vehicles and ADAS, Computer Vision, Artificial Intelligence, CloudTech, Enterprise Software, Information Security, Digital Entertainment & Lifestyle, Health Tech, Internet of Things, Networking / Infrastructure, Robotics, Semiconductors, Batteries, Energy Storage, Aerospace and Defense. Woodside Capital Partners is a specialist in cross-border transactions, with extensive relationships among venture capitalists, private equity investors, and corporate executives from global 1000 companies. More about Woodside Capital Partners here.

Questions? Contact George Jones, Managing Director, Woodside Capital Partners at [email protected].