Inertial measurement units, or IMUs, form the backbone of the physical layer of modern navigation systems. According to IDTechEx‘s research report, “Next-Generation MEMS 2026-2036: Markets, Technologies, and Players“, high-end IMUs constitute a US$3.8 billion global market.

IMUs are continually evolving to serve a diverse and challenging set of performance requirements from industry. In particular, IDTechEx research covers the two driving forces behind much of sensor evolution, better performance in a smaller package.

Simple inertial sensors detect motion along an axis, either linear (via an accelerometer) or rotational (via a gyroscope). Combining 3 perpendicular accelerometers and 3 gyroscopes gives a 6-axis IMU, which is sufficient to detect motion along the X, Y, and Z plane.

In theory, if the initial coordinates are known, then a 6-axis IMU is sufficient to provide vectoral coordinates indefinitely. However, no sensors are perfect, and a combination of inherent Newtonian noise, sensor instability, and drift compound to make the sensor less accurate over time. To compensate for this discrepancy, modern inertial navigational systems (INS) regularly update their location with global navigational systems satellite (GNSS) signals, and it is this combination of periodically interfaced (GNSS) data and IMU sensor data that provides a useful navigational reading. The quality or ‘grade’ of IMU often indicates what magnitude of error accumulates over time.

The actual path travelled by the object differs from the path that the IMU calculates due to the accumulation of drift and other sensor errors. Without correction from a GNSS signal, this reading becomes useless.

The actual path travelled by the object differs from the path that the IMU calculates due to the accumulation of drift and other sensor errors. Without correction from a GNSS signal, this reading becomes useless.

Grades range from consumer to aerospace

There is no industry-standardized classification of IMU performance, but in general IMUs are split based on performance. In this context, performance refers to accuracy (closeness of the sensor value to the actual value) and drift (deviation of sensor value over time). Although GNSS can correct for a drop in performance, for certain applications it is highly desirable for a system to be able to operate for longer periods of time without access to a stable GNSS signal.

The application of an IMU could vary from precise long-term navigation of a commercial airliner to gesture recognition in a smartphone – both are IMUs but have drastically different requirements in performance and CSWaP Cost, Size, Weight, and Power. Optimizing IMU involves selecting the right performance while minimizing CSWaP.

Gyroscopes are the weak link in IMUs

There is a broad variety of sub technologies available across both accelerometers and gyroscopes.

MEMS (Microelectromechanical systems) are produced on silicon substrates at microscopic scales. Most accelerometers (across performance grades ) are MEMS design, but for gyroscopes there is typically a wider range of options due to the lower performance of most MEMS gyroscopes. The key technology options are outline below.

- MEMS Gyroscopes. These are typically the cheapest and smallest gyroscope (but performance is improving). Most designs are based on the Coriolis effect, where two ‘tines’ are driven to oscillate and when an external rotation is applied the Coriolis effect induces an acceleratory. By measuring this displacement, one can infer the angular rotation. However the Coriolis induced displacement is very small, meaning it is challenging to measure this accurately. More advanced MEMS gyroscopes use more complex geometries, such as the quad-mass tuning fork.IDTechEx has also identified new and emerging MEMS gyroscopes, such as micro-hemispherical resonator gyroscopes and these are covered extensively in “Next-Generation MEMS 2026-2036: Markets, Technologies, and Players“.

- Ring Laser Gyroscopes (RLG). RLGs rely on the Sagnac Effect, in which a beam of light is split into following the same path along a ‘ring’ but in alternate directions. Once the path is completed, the beams exit, and they undergo interference. In the absence of an external rotation, the light beams travel the same distance and thus arrive in phase. However, in the presence of external rotation, the beams travel slightly different lengths, and the resulting interference can be measured and used to determine the angular rotation. To avoid ‘lock-in’ (phenomena where the counter-propagating laser modes become almost identical at low frequencies), a mechanical piezoelectric ‘dithering’ motor is often used to induce a steady state oscillation (which can then be eliminated from angular velocity calculations). RLGs have excellent stability and low drift but are expensive due to their sophisticated design and complex manufacturing.

- Fibre Optic Gyroscopes (FOG). Fibre Optic Gyroscopes (FOGs) use very similar physical principles to those of RLGs, except that instead of a closed loop cavity, laser light is passed through a coil of fiber-optic cable. These coils can have lengths ranging from 100m to 3km and have some advantages over an RLG, such as not requiring a high-voltage light source. By modifying the length of the coil, the performance of a FOG can be scaled up and down (e.g., doubling the coil length decreases the ARW by a factor of 2). FOGs are also purely solid state, meaning they do not need the precision mirrors, gas-filled laser tubes, and dithering assemblies of RLGs, and as a result are often cheaper to produce (but still much more expensive than MEMS).

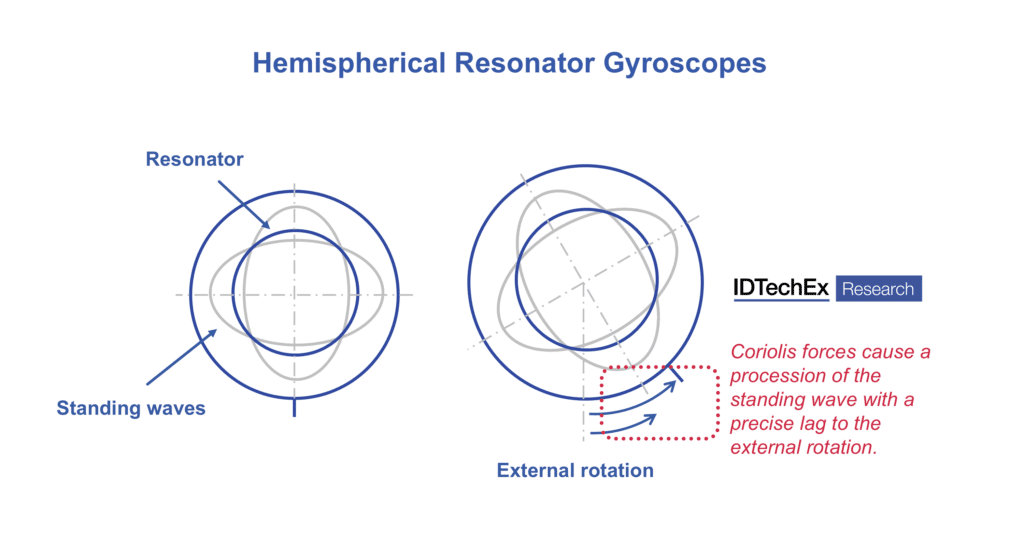

- Hemispherical Resonator Gyroscopes (HRG). HRGs are high-performance vibratorygyroscopes that make use of the Coriolis effect. In a typical setup, a hemispherical shell of fused quartz is driven to a flexural resonance by electrostatic forces generated by electrodes deposited onto the second fused quartz structure that surrounds the shell. The electrostatic forces establish standing waves on the rim of the shell, which, due to the Coriolis effect, do not rotate with the peripheral rotation of the shell as the gyro is rotated around its axis. By measuring the phase delay between the two degenerate modes, the angular displacement can be determined. HRGs are extremely high performance and are often favoured in space applications, but they are extremely expensive and complex to produce. IDTechEx has only identified a handful of companies producing HRGs.

Overview of the basic principles of a hemispherical resonator gyroscope (both micro and macro scale). This design requires a very high Q-factor hemisphere with very few defects manufactured at very low tolerances.

Overview of the basic principles of a hemispherical resonator gyroscope (both micro and macro scale). This design requires a very high Q-factor hemisphere with very few defects manufactured at very low tolerances.

Bringing HRG design to MEMS scale

One of the most exciting trends in the gyroscope technology landscape is the pursuit of high-end performance MEMS designs, bringing the CSWaP advantages of MEMS but with tactical or even navigational grade performance of RLGs, FOGs, and even HRGs. A variety of new geometries are being explored, but one of the most promising is the miniaturization of the HRGs to MEMS scale, leveraging the same physical principle as the macro-scale HRG. By relying on standing waves around a hemispherical shell, much greater gyroscope performance is attainable.

The main barrier to what IDTechEx terms μHRGs is manufacturing a wafer scale, defect free, high Q-factor hemisphere. The report “Next-Generation MEMS 2026-2036: Markets, Technologies, and Players” covers key approaches to micro hemisphere fabrication; Micro-glass Blowing, Blowtorch blowing, 3D Printing (PμSL), and thin-film deposition, outlining merits, challenges, processes, and materials for each. Early results indicate promising improvements in Bias Instability and Angular Random Walk, but it is a long way from the lab-bench to large scale MEMS fabrication.

What applications are there for high-end gyroscopes?

Historically, high-end gyroscopes and IMUs have been reserved for high-end defense and aerospace applications due to the high costs of the sensors. Low-cost, high-quality MEMS gyroscopes could unlock inertial sensing-driven autonomous vehicles (which currently rely on a mix of inertial and non-inertial sensors). With typical car costs running around $30-70k, a $10-100k IMU is simply out of reach. However an order of magnitude reduction (achievable with MEMS could bring sensors capable of guiding autonomous vehicles independently from a GNSS signal for a short period of time.

The majority of the high-end IMU market is forecast by IDTechEx to be largely driven by a strongly growing defense industry, and is predicted to reach $6.5 billion by 2036 according to “Next-Generation MEMS 2026-2036: Markets, Technologies, and Players“, with IDTechEx projections split by FOG, RLG, HRG, MEMS gyroscopes (both incumbent and advanced).

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/NextGenMEMS, or for the full portfolio of research available from IDTechEx, see www.IDTechEx.com.

Mika Takahashi

Technology Analyst, IDTechEx