This market research report was originally published at the Yole Group’s website. It is reprinted here with the permission of the Yole Group.

Yole Group unveils two new reports, PiezoMEMS Technologies 2025 and PiezoMEMS Comparison 2025, providing market ranking, technology insights and cost analyses.

Key Takeaways

- The piezoMEMS market will reach nearly US$5.7 billion by 2030, growing at a 6% CAGR (2024–2030), ahead of the overall MEMS industry’s 3.7% growth. (1)

- Beyond RF MEMS, 10+ products are choosing piezoelectric thin film deposition technology, like microspeakers, microphones, MEMS oscillators, autofocus, micro-cooling,…

- RF MEMS leaders Broadcom and Qorvo continued to dominate the market in 2024.

- Technology status: innovation is accelerating, with hundreds of millions of dollars raised since 2020, and new partnerships.

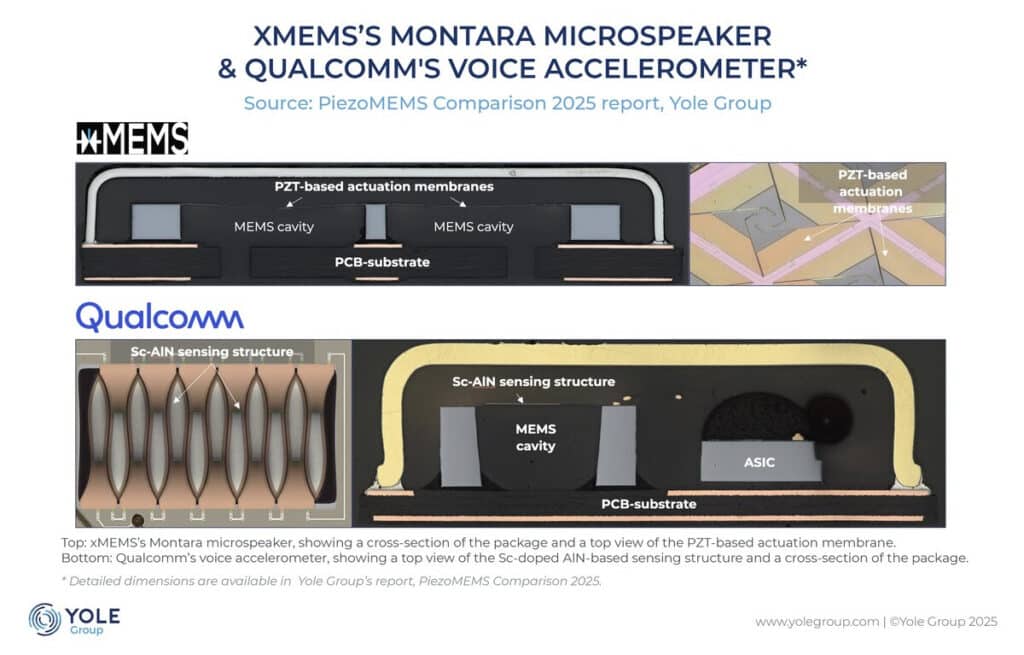

- AlN, including Sc-doped AlN, and PZT are the principal thin-film deposition materials for transducers, each providing distinct sensing and actuation characteristics.

Beyond RF MEMS, piezoMEMS is emerging as one of the most dynamic segments in the MEMS industry. This technology is particularly impactful in consumer electronics, where it powers microspeakers, microphones, MEMS autofocus, and several new sensors and actuators currently in development. While the market slowed in the past two years due to global economic headwinds, it is now set for renewed momentum.

By 2030, piezoMEMS will represent a US$5.7 billion market, growing faster than the MEMS industry average, announces Yole Group in its PiezoMEMS Technologies 2025 report.

Technology foundations: from thin films to high-performance devices

Piezoelectricity has been known for nearly a century, yet only a handful of materials can be effectively scaled to semiconductor processes. Thin-film PZT, AlN, and Sc-doped AlN each bring distinct properties that define performance for targeted applications.

These material choices are reflected in the wide diversity of products in which thin-film AlN deposition is more applicable to sensing applications, while thin-film PZT contributes mainly to actuating properties. Several foundries have developed strong expertise in piezoelectric deposition capabilities. Along with foundries, manufacturers are leveraging partnerships and innovative business models to reduce development timelines, thus accelerating market entry and broadening the adoption of piezoMEMS-based solutions.

Oleksii BratashPhD, Technology & Cost Analyst for MEMS & Sensing at Yole Group:

In piezoMEMS, we see the convergence of proven materials science and advanced semiconductor manufacturing. This combination explains the rapid proliferation of products and applications, from audio components to next-generation sensing platforms.

Comparative insights: analyzing eleven piezoMEMS devices

Yole Group’s PiezoMEMS Comparison 2025 report dissects the structure, fabrication, and cost of eleven components. This report provides a comprehensive review of eleven devices across microspeakers, voice accelerometers, microphones, ultrasonic sensors, and MEMS autofocus for lenses.

These include:

- Microspeakers with Montara, Cowell from xMEMS; Achelous, Conamara from USound found in consumer devices such as Singularity ONI, and SoundPEATS Capsule3 Pro+, and MEMS-3S from Soranik Hearing.

- Voice accelerometers and microphones from Qualcomm (formerly Vesper) integrated into Technics earbuds, Misfit smartwatches, and Arlo cameras.

- And ultrasonic and optical devices, including TDK’s CH-101 range sensors and poLight ASA’s TLens® autofocus lens, embedded in AR/VR devices such as the Magic Leap 2 and HTC Vive Focus Plus.

Yole Group’s reverse engineering & costing report highlights how differences in MEMS processes, packaging, ASIC nodes, and structural designs shape performance and costs, enabling manufacturers to differentiate their products in a competitive market. Using Scanning Electron Microscopy (SEM) and Energy Dispersive X-ray (EDX) techniques, Yole Group is able to analyze the piezoelectric layers of each examined device, along with material characteristics, deposition technique, and thickness.

“By comparing piezoMEMS devices across architectures and cost structures, we provide a unique perspective on where innovation truly happens and how value is created in the supply chain,” says Oleksii Bratash from Yole Group.

With more than ten product categories already identified and strong momentum from both established players and new entrants, piezoMEMS is cementing its role as a growth engine within the MEMS industry. Through its two reports, PiezoMEMS Technologies 2025 and PiezoMEMS Comparison 2025, Yole Group delivers unparalleled insight into the market dynamics, technological innovations, and cost breakdowns shaping this fast-moving field.

Stay tuned on www.yolegroup.com for more MEMS technology and market analyses!

(1) Source: Status of the MEMS Industry 2025 report, Yole Group

Source: www.yolegroup.com