This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

OUTLINE:

-

Market forcasts:

The automotive radar market will grow 19% annually to reach US$10.4 billion by 2025.

Automotive radar market growth has been impressive in the last decade and will continue till 2025 with the trend to ADAS and HAD.

-

Technology trends:

Downsizing of the RF board, whatever the frequency range.

Continental SRR and LRR radar sensors are showing the least integration:

– Both devices are based on the same RF board area.

– MMIC integration is also the same for both devices.

Infineon Technologies and NXP: both MMIC market leaders, trend is to integrate more digital functions per die.

-

Ecosystem:

European companies lead the automotive radar market.

The top developing module units are Continental, Hella/Mando, Robert Bosch, DENSO TEN, and Veoneer.

“In the next few years, autonomous driving will become a reality,” asserts Stéphane Elisabeth, PhD. Senior Technology and Cost Analyst at System Plus Consulting. “To achieve this goal, the number of vision technologies has increased to provide more and more functionalities in addition to safety for drivers and passengers.”

Among these vision technologies, radar systems are the best-established and most secure. Radar systems were introduced in 2000, with SRR systems dedicated to blind-spot detection or rear cross-traffic alert. Today, vehicles from several suppliers are already offering ‘level 2+’ automation whereby drivers are on standby but can be hands-off for periods of time. These vehicles integrate around five radar systems, including SRR and LRR, which support emergency breaking and adaptative cruise control.

System Plus Consulting, the reverse engineering and costing company, tracks daily radar technologies, evolution, and innovations. It is now the perfect time to investigate the latest developments and compare them to each other. System Plus Consulting’s analysts deliver today a comprehensive and detailed comparison of existing solutions offered by leading OEMs and module suppliers.

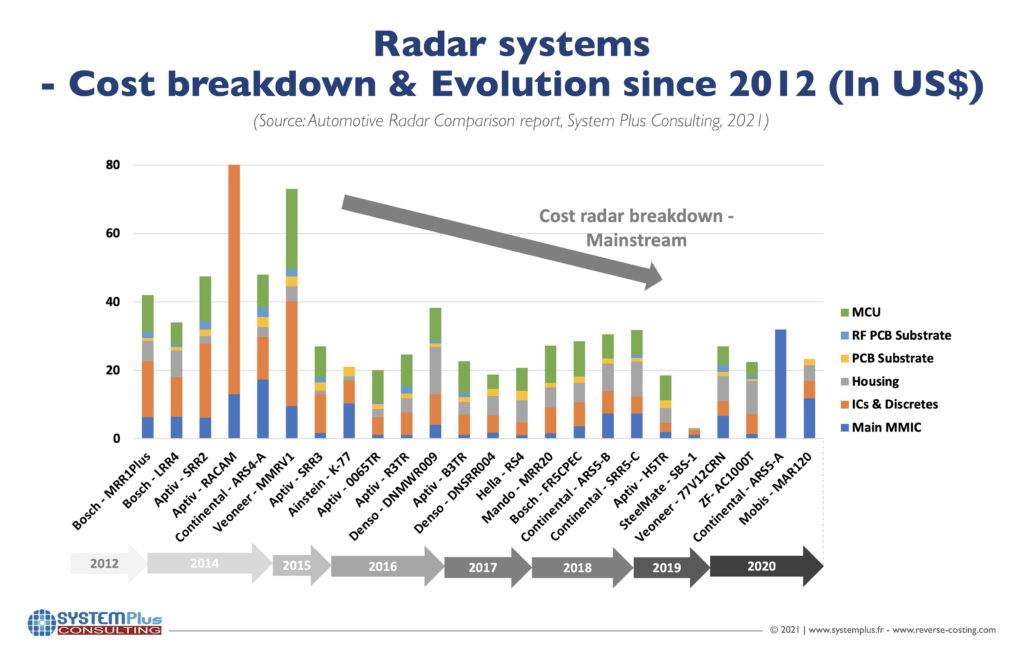

This comparative technology study, Automotive Radar Comparison 2021, provides valuable insights regarding technology data for RF chipsets and antenna boards in radar systems. This reverse engineering and costing analysis includes a study of 15 radar systems from leading OEMs, such as Veoneer (formerly Autoliv), Robert Bosch, Aptiv (formerly Delphi Technologies), Denso, ZF/TRW, Hella, Hyundai/Mobis, and SteelMate. This report also analyzes the first imaging radar from Continental, which has also been evaluated through a dedicated teardown: Continental ARS5-A ARS540 4D Long-Range Radar (66 31 5 A55 CB1).

According to Yole Développement (Yole), the radar market for automotive and mobility applications should reach more than US$10.5 billion, with an 11% CAGR between 2019 and 2025. Automotive & mobility is the most dynamic market segment with road safety requirements pulling radar as a mainstream technology, explains the market research & strategy consulting company in its dedicated report.

Cédric Malaquin, Technology & Market Analyst, RF Devices & Technology at Yole:“Radar offers interesting capabilities for autonomous driving. It will be a robust solution in the sensor mix.”

Radar developments have been accelerating thanks to the maturity of the industry. Imaging radar could be the “good enough” solution when it becomes commercially available from 2021.

Through teardowns of a large variety of radar systems, Yole’s partner, System Plus Consulting, has extracted the main RF chipsets and boards and physically analyzed them. The company has also sectioned the RF boards to point out the various OEMs’ technology and economic choices.

“Market share differs depending on the frequency and the automotive application,” explains Stéphane Elisabeth from System Plus Consulting. “At 24 GHz, STMicroelectronics’ solution is at the low end. At 77 GHz, Infineon Technologies and NXP have led the way for many years. But it appears that Texas Instruments is catching up.”

The 2nd edition of the radar comparison report is a significant analysis of state-of-the-art radar technologies. This study points out the technical strategy of each leading company, the OEMs and module makers, and the supply chain they have set up to support them. It highlights their vision of the automotive industry and how they expect to penetrate it. Make sure to get a relevant perception of your environment with this new report from System Plus Consulting.

Throughout the year, the Yole Group of Companies, including System Plus Consulting and Yole Développement, publishes numerous RF electronics reports and monitors. In addition, experts realize various key presentations and organize key conferences. More info

Discover the numerous RF electronics-related reports and make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews.

Stay tuned!

Extracted from:

- Automotive Radar Comparison report, System Plus Consulting, 2021

- Status of the Radar Industry: Players, Applications and Technology Trends report, Yole Développement, 2020

Acronyms:

- CAGR: compound annual growth rate

- OEM: Original Equipment Manufacturer

- EV/HEV: Electric and Hybrid Electric Vehicle

- SiC : Silicon Carbide

- GaN : Gallium Nitride