This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

ADAS to AD sensor & computing market is showing a 12.1% CAGR between 2021 and 2027. Yole Développement (Yole) announces a US$25 billion market at the end of the period.

Lyon, France, March 23d 2022 – The market research and strategy consulting company Yole Développement (Yole) and its partner System Plus Consulting have been analyzing the semiconductor industry for several years, with a particular focus on automotive applications. In 2035, C.A.S.E will be a US$318 billion market, and the semiconductor value in a car will reach US$78.5 billion in 2026, with a 14.75% CAGR between 2020 and 2026, announces Yole in its Automotive Semiconductor Trends report… Those figures point out the crucial role of automotive players in the development of semiconductor innovations and business opportunities.

![]()

All year long, Yole and System Plus Consulting analysts deliver a comprehensive understanding of the industry, combining technical trends and market evolution. Based on a dedicated methodology and high-added value expertise in the semiconductor technologies applied in the automotive sector, the two companies publish numerous analyses, including technology and market reports, quarterly market monitors, and dedicated teardown tracks throughout the year. More information.

It took ten years to happen… ADAS technologies used to be considered a ‘nice to have’ feature for safety-conscious family car owners. It has now become the new frontier for technology companies like Intel, Qualcomm, Huawei, Apple, Google, and Tesla… So, what has happened and what is next to come?

Pierre Cambou, Principal Analyst Imaging at Yole, comments: “The C.A.S.E megatrends have taken the industry by storm, the whole ecosystem including automotive companies, semiconductor manufacturers… is moving to adapt to this massive transformation.”

The reorganization of the industry

Mobileye, from Intel, filling for an initial public offering at an estimated value of US$50 billion is a sign of the times when the same number was achieved by Xilinx, acquired by Intel’s competitor, AMD, in February 2022. A few months back, Waymo, the autonomous vehicle arm of Google, was raising US$2.3 billion at a value of US$30 billion while Huawei was shifting 10,000 employees from mobile activities, hit by US sanctions, to autonomous vehicle technology research. Other examples can be mentioned: BMW willing to fight off Tesla by partnering with Qualcomm and Arriver™, the perception venture born from the US$4.5 billion acquisition of Veoneer… More news available on i-Micronews.com.

There is an endless list of noteworthy news pointing toward industry reorganization. Therefore, all semiconductor and technology giants are looking into the ADAS to AD transition, the new center of gravity of the AI revolution.

Road mobility is a US$10 trillion market. ADAS to AD technology could be the magic ring to command it all. This includes cameras, radars, LiDARs, and a lot of edge and cloud computing. Yole’s automotive analysts predict ADAS to AD technology to grow at 12% CAGR for the 2021-2027 period, reaching, at the electronic module level, US$25 billion in 2027.

“Today, only 12.3% of the 1,300 million cars on the road worldwide are fitted with ADAS technology,” explains Pierrick Boulay, Senior Technology & Market Analyst, Lighting and Display at Yole. “This figure will rise to 49% of the 1,800 million cars on the road estimated for 2030. This evolution is due to the huge increase in penetration of the technology in cars produced every year. From 21% five years ago, ADAS is now fitted onto 65% of all vehicle production in 2022, and this number will reach 86% by 2027.”

The long road to autonomy

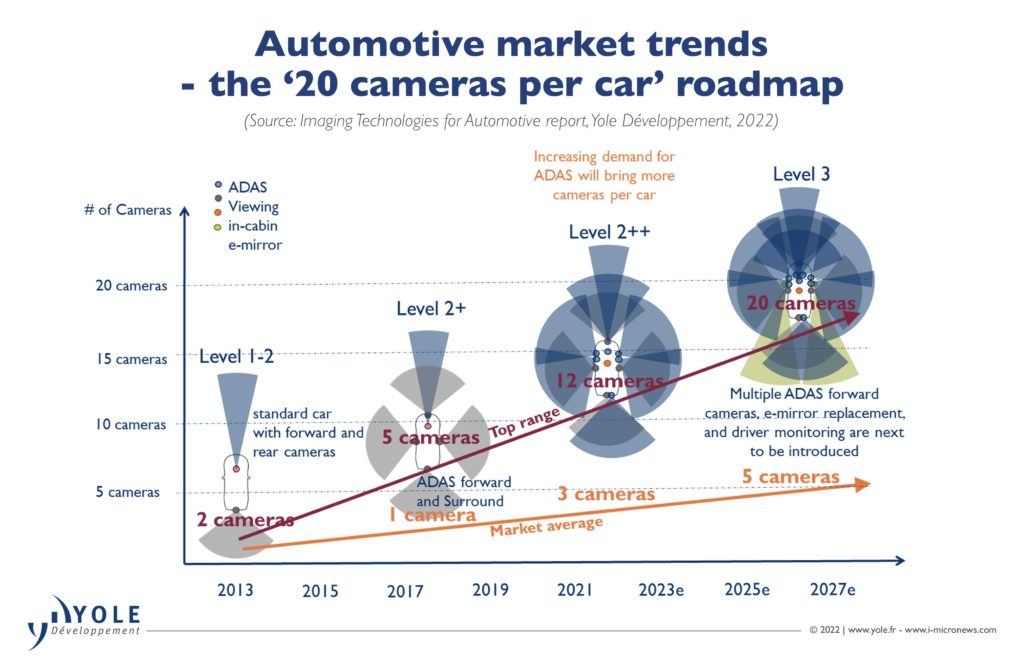

While quantitatively the transition is almost total, the qualitatively new generations of hardware are dubbed with ‘Level of autonomy’ increments, originally Level 1. Level 1 includes improved cruise control that could provide warnings to drivers. Then a transition came to Level 2 in different flavors: Level 2+ and now Level 2++ for cars with automated steering and braking, under supervision; in certain ideal conditions, and we cannot yet call it “autonomous driving”, but it is clearly at the top end of “advanced driving assistance”, states Yole’s analysts. The excitement is therefore palpable at Level 2. Key enabling technologies that benefit from this evolution are cameras, radars, LiDARs, and computing chips.

In the Imaging for Automotive report, Yole’s imaging team describes the US$440 worth of electronic content needed for Level 2+ cars of 2017, which is jumping toward US$3,270 for state-of-the-art Level 2++ cars such as top-end Tesla, the recently released Honda Legend, and upcoming Mercedes S-class. The threshold toward completely removing the eyes of the driver from the road is nearby. This is the indication that Level 3 has been reached, the Kàrmàn line for autonomy which then extends to Level 4 and even Level 5… Read the full article on i-Micronews.

Acronyms:

- ADAS: Advanced Driver-Assistance System

- AD: Autonomous Driving

- CAGR: Compound Annual Growth Rate

- C.A.S.E: Connectivity, ADAS, Sharing, Electrification