This market research report was originally published at Woodside Capital Partners’ website. It is reprinted here with the permission of Woodside Capital Partners.

Palo Alto – July 29, 2022 – Woodside Capital Partners (WCP) is pleased to share our Industry Report on the AI Semiconductor Market 1st Half 2022, authored by Managing Director Shusaku Sumida.

This report covers the following aspects of the Semiconductor Market for the 1st half of this year:

- VC Funding Activity and Trends

- Significant Investments

- Thoughts on SPAC

- Notable Industry Events

- Investments by Country

- 2022 2nd Half Expectations

- 147 Startups by Tech Type

Investment Activities in AI Semiconductor Startups in the 1st Half of 2022

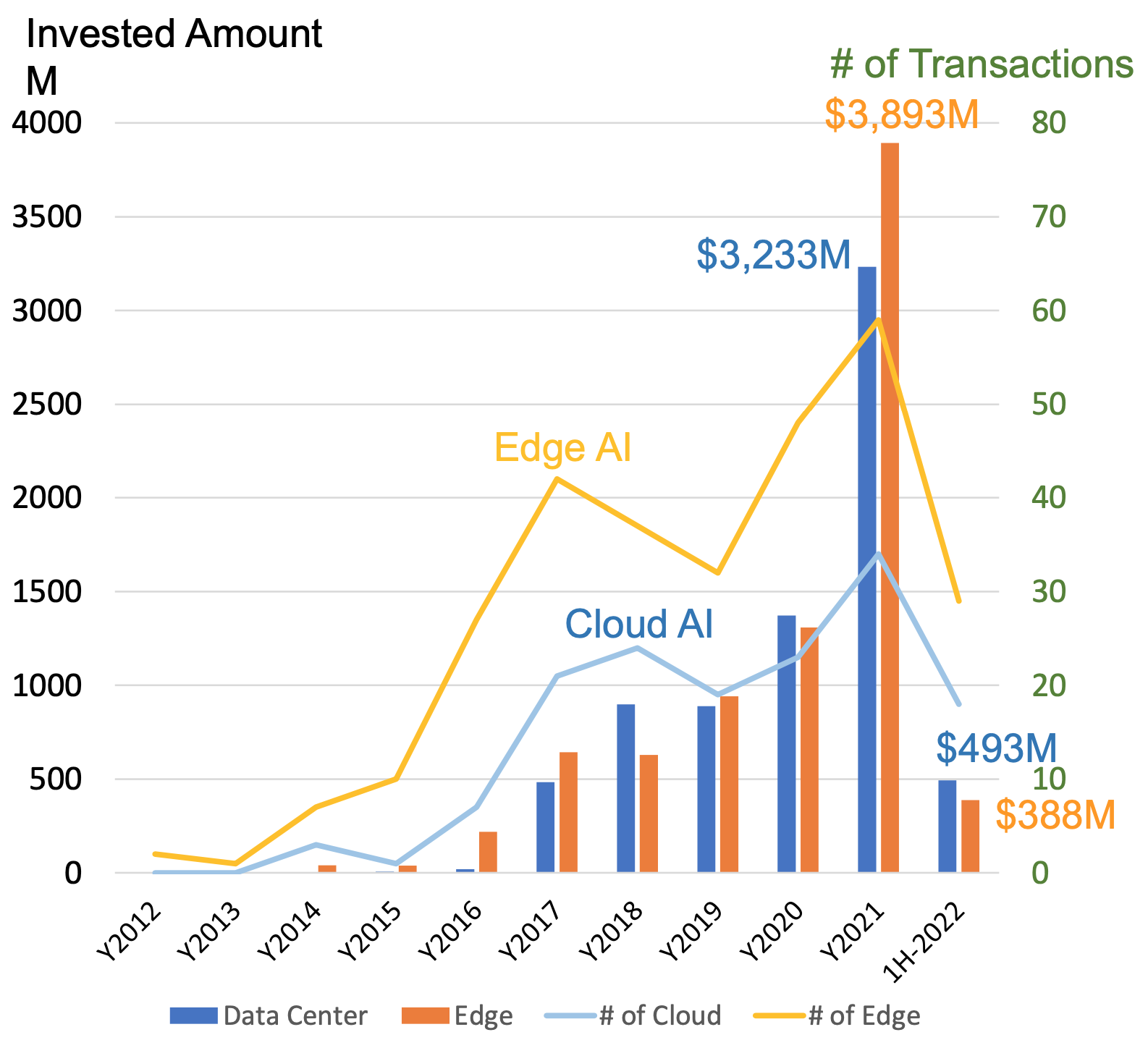

Investment in AI semiconductors in 2021 hit a record high; $7.1B was invested in 70 companies (half of startups) in 93 transactions in the world. One reason is that $2.55B, 36% of the whole investment was made in one startup, Horizon Robotics in China, which focuses on Automotive Tech, in Q1 and Q2.

63% of the transactions were made in Edge AI. Investment in Cloud AI is also strong, with almost $1B invested in SambaNova and Groq.

1H of 2022, the investment in global startups was significantly reduced to only $881M with 47 transactions. Many transactions made in China did not disclose the invested amount. Since the number of transactions is at the same level as 2021, we guess probably $1.5B or more was invested. Also, we think the investment is becoming more selective.

AI Semiconductor is one of the core technologies to drive digitalization, VC investment will be more selective.

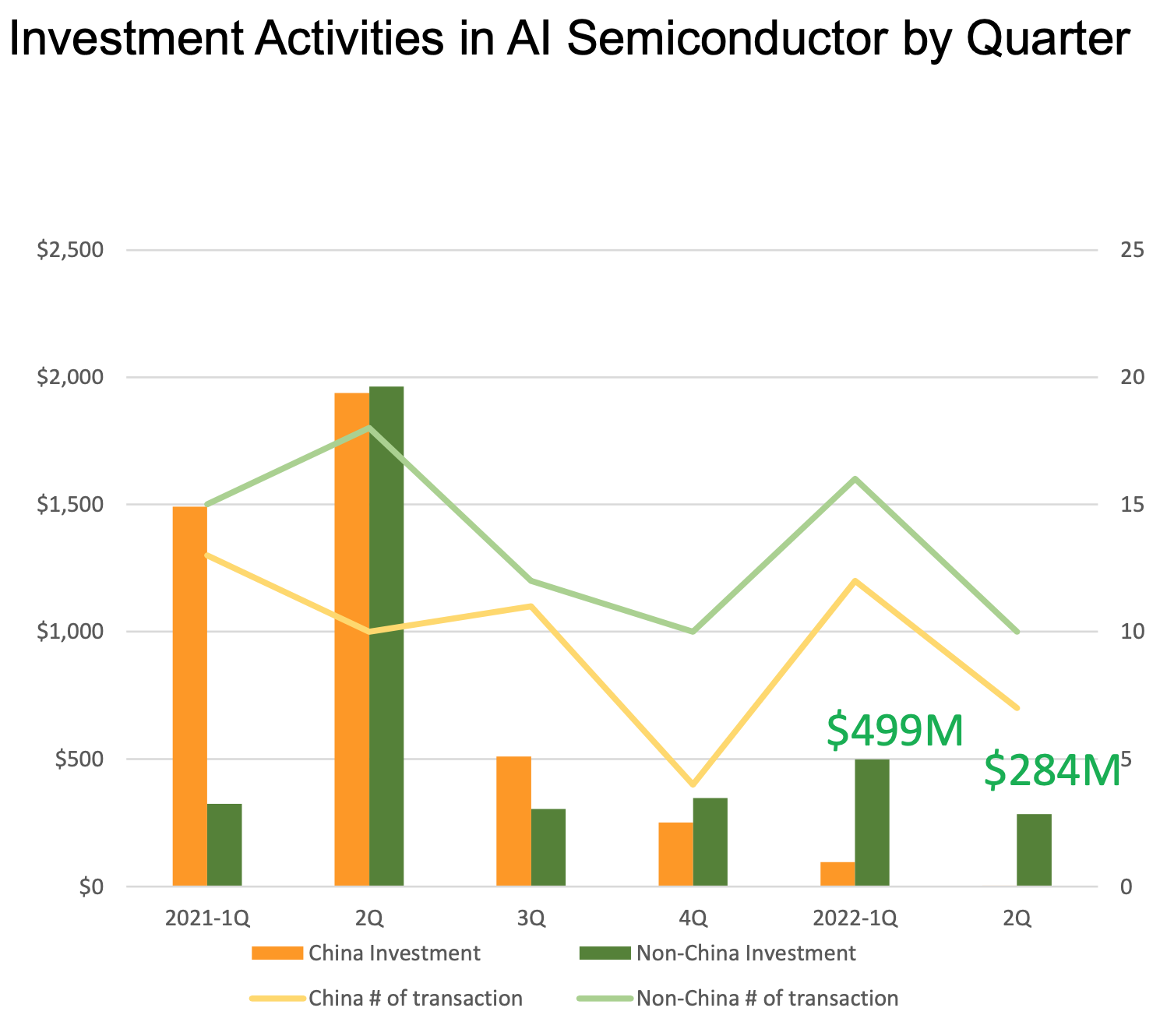

Let’s look a little more at the details of the quarterly movement. Referring to investment activities outside China in the last 4 quarters, it looks more constant, considering the situation of continuing COVID-19 and concerns on the global economy provided by increasing Interest rates, and global division by the Russian Invasion.

Regarding the investment in China, it looks like the interest in AI semiconductors continues to be strong.

The world economy started re-splitting into East and West. This trend will negatively impact the world economy and investment into AI semiconductor type of strategic items.

About the Author

Shusaku Sumida joined WCP in 2010 and is FINRA-licensed and registered, Series 79 & 63.

He has over 30 years of global experience in engineering, sales & marketing, operation, strategic planning, and management in the Semiconductor industry, including experience in Japan, Hong Kong, and the USA.

He founded Oki’s Hong Kong operation, founded Silicon Dynamics, a Networking LSI development group under Oki Semiconductor, and ran Oki Semiconductor USA, a $300M operation which included sales, marketing, design center, and R&D.

He served as a Technology Advisory Board member of the Pittsburg Digital Greenhouse (2001-2005) and also participated in the founding of the startups of Silicon Clocks, Passif Semiconductor, and eStat.

He is a visiting lecturer on Growth Strategy of Startups at BBT Kenichi Ohmae School of Business and is an advisory board member of Nagoya University’s DII DR Program.

He received a BE in Material Science from Kyoto University in Japan.

About Woodside Capital Partners

Woodside Capital Partners is the leading corporate finance advisory firm for tech companies in M&A and financings in the $30M-$500M segment. The firm has worked with the best entrepreneurs and investors since 2001, providing ultra- personalized service to select clients. Our team has global vision and reach, and has completed hundreds of successful engagements. We have deep industry knowledge and extensive domain experience in the following sectors: Autonomous Vehicles and ADAS, Computer Vision, Artificial Intelligence, Cloud/Enterprise Software, Cybersecurity, Digital Entertainment & Lifestyle, Health Tech, Internet of Things, Marketing Technology, Networking / Infrastructure, and Robotics. Woodside Capital Partners is a specialist in cross-border transactions, with extensive relationships among venture capitalists, private equity investors, and corporate executives from global 1000 companies. More about Woodside Capital Partners here.

The remainder of Woodside Capital Partner’s report can be found here.