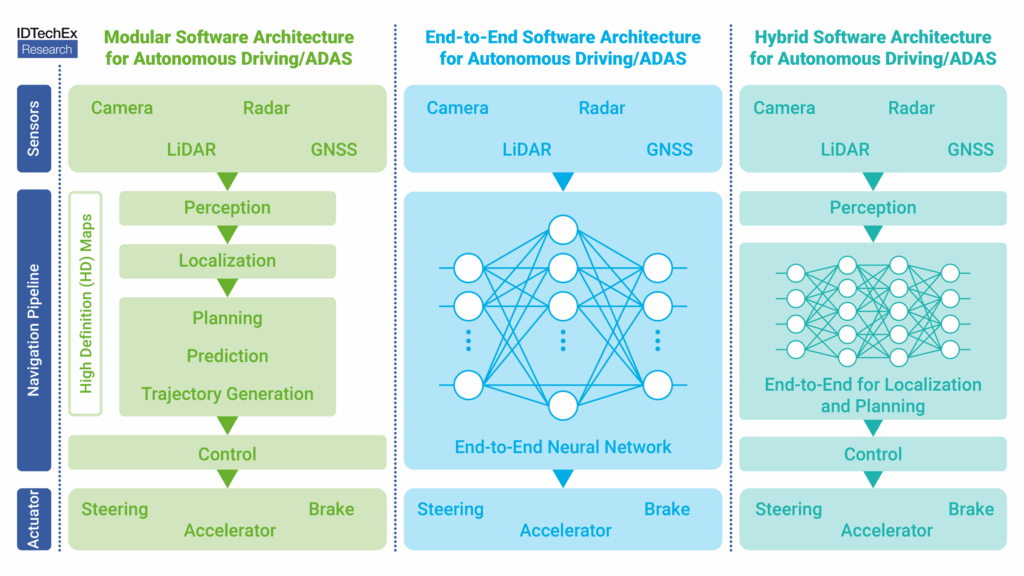

Examples of modular, end-to-end, and hybrid software architectures deployed in autonomous vehicles.

Autonomous vehicle technology has evolved significantly over the past year. The two market leaders, Waymo and Apollo Go, both have fleets of over 1,000 vehicles and operate in multiple cities, and a mix of large companies such as Nvidia and Aptiv, OEMs such as Tesla and Volkswagen, and unicorns such as Wayve and Pony AI have made large strides in autonomous driving systems. In IDTechEx’s new report, “Autonomous Driving Software and AI in Automotive 2026-2046: Technologies, Markets, Players“, the role of these different players and their approaches are analyzed, compared, and used to forecast the overall autonomous driving software market.

As software becomes an increasingly important differentiator and component of autonomous driving, the term ‘end-to-end’ has been used to describe a new approach to autonomous driving software. End-to-end autonomous driving systems are defined by the input of raw sensor data into a deep learning model, and outputting vehicle control commands such as steering, acceleration, and braking. This represents a paradigm shift from the traditional modular software approach used in autonomous vehicles.

Modular software is proven and on roads

Both the market leaders (Waymo in the US, Apollo Go in China) deploy a form of modular software for autonomous driving. The concept of modular software is that specific purposes (e.g., perception, localization, route planning, and actuation) are containerized into specific software modules, with hard-coded, defined rules that define the behavior and actions of the vehicle.

These systems will take data from multiple sensors (e.g., cameras, mm-wave radar, LiDAR) and combine this via sensor fusion. In combination with high-definition (HD) maps, the output of, for example, the perception module, is fed as the input into the localization module, in a sequential manner until the vehicle’s overall action is decided and acted upon. Although companies have different strategies, such as the inclusion of additional modules or combining two modules into one, the general approach is the same. This has worked well in practice and is also used in most ADAS (up to SAE L2+) systems on roads today.

Is end-to-end the final goal?

The argument made by many in the industry is that the modular software structure is not optimal. Each module has a different objective, e.g., accurate positioning, maximizing safety and comfort, and therefore the entire system does not have a unified target. In some ways, an end-to-end approach is ‘simpler’ due to the singular model being jointly trained for all applications (perception, prediction, planning). Furthermore, compared to one end-to-end network, a multi-task, multi-model deployment can involve multiple encoders and transmission systems, increasing the computational power required and potentially leading to sub-optimal use of compute.

There exists what is known as the “long tail” problem of autonomous driving, where pre-defined human rules and code struggle to translate to complex driving situations. A situation that has not been accounted for by the system design can throw off the model, potentially leading to accidents.

As a result, many companies are pursuing an end-to-end model for autonomous driving, such as Wayve and Turing. By being trained on vast amounts of real-world and simulated driving data, the end-to-end network learns by imitation and reinforcement, similar to how humans develop driving intuition, instead of following hard-coded rules. Companies backed by extensive corporate funding, such as Waymo (Alphabet) and Motional (Hyundai), are also developing end-to-end approaches for autonomous driving. However, to IDTechEx’s knowledge, these are yet to be deployed commercially.

The ‘black box’ problem of end-to-end models

The deployment of one end-to-end network for all tasks and actions yields a significant problem in interpretability. Essentially, it is much more difficult to explain an end-to-end network, since the raw sensor information is the input, and the appropriate action is the output, with no clear direction or path taken in between. This is often referred to as a ‘black box’.

This lack of interpretability yields several concerns. For engineers, end-to-end networks are more challenging to debug, and may also struggle with societal acceptance and trust. Perhaps most importantly, how can a company prove that its autonomous systems are safe and in line with regulations when it is an end-to-end network? For example, the EU Artificial Intelligence Act, published in July 2024, emphasizes the need for traceability and explainability in AI systems. As of July 2025, it remains unclear whether a fully end-to-end network would meet those requirements.

What is happening right now? Hybrid systems

A fully end-to-end network for autonomous driving, despite its advantages, has proven challenging and impractical to deploy. While it is true that end-to-end can theoretically learn to drive like a human can, there are certain parts of autonomous driving, such as localization and route planning, which may benefit from the high reliability and interpretability of hard-coded algorithms. While companies differ in their approach, IDTechEx believes that even companies that claim to have an end-to-end network for autonomous driving will have some deterministic algorithms integrated for certain tasks. Neural networks of different sizes can be combined with intermediate inputs, defining a hybrid approach that IDTechEx believes holds significant potential in the short term.

John Li

Technology Analyst, IDTechEx

IDTechEx analyzes modular, end-to-end, and hybrid approaches to autonomous driving in its new report, “Autonomous Driving Software and AI in Automotive 2026-2046: Technologies, Markets, Players“. The report also includes yearly market forecasts for autonomous driving software, split by region and SAE level.

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/ADSandAI, or for the full portfolio of autonomous vehicle-related research available from IDTechEx, see www.IDTechEx.com/Research/Autonomy.