For more information, visit https://www.berginsight.com/the-video-telematics-market.

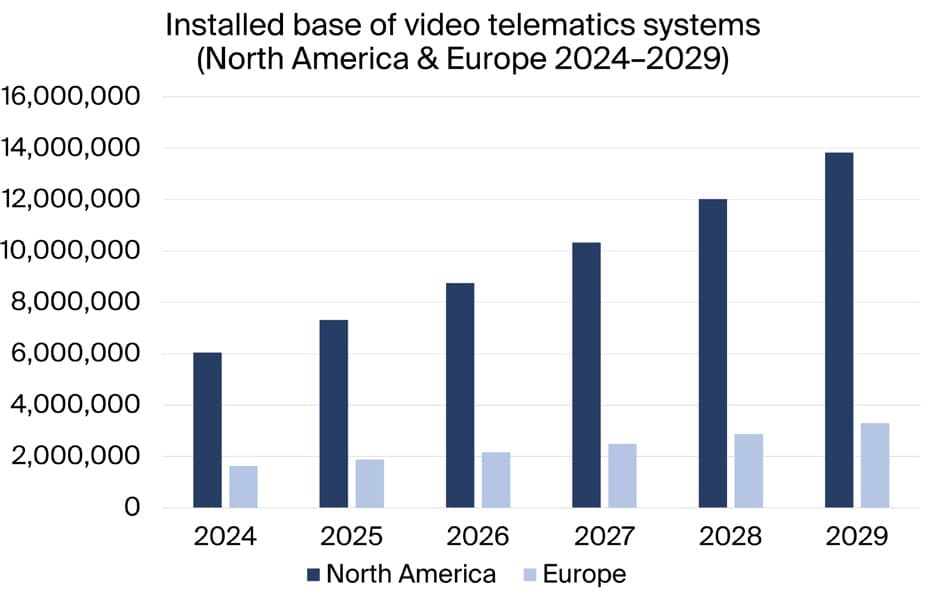

The integration of cameras to enable various video-based solutions in commercial vehicle environments is one of the most apparent trends in the fleet telematics sector today. Berg Insight’s definition of video telematics includes a broad range of camera-based solutions deployed in commercial vehicle fleets either as standalone applications or as an additional feature set of conventional fleet telematics. Berg Insight estimates that the installed base of active video telematics systems in North America reached almost 6.1 million units in 2024. Growing at a compound annual growth rate (CAGR) of 18.0 percent, the active installed base is forecasted to reach over 13.8 million units in North America by 2029. In Europe, the installed base of active video telematics systems is estimated to be over 1.6 million units in 2024. The active installed base is forecasted to grow at a CAGR of 15.2 percent to reach 3.3 million video telematics systems in Europe by 2029.

The video telematics market is served by many companies, ranging from specialists focused specifically on video telematics solutions for various commercial vehicles, to general fleet telematics players which have introduced video offerings, and hardware-focused suppliers offering mobile digital video recorders (DVRs) and vehicle cameras used for video telematics. Berg Insight ranks Streamax, Lytx and Samsara as the leading video telematics players in their respective categories. Streamax is the leading hardware provider, having more than 4 million mobile DVRs installed in vehicles globally to date, and the company also offers software dashboards which are widely used together with its devices. Lytx is the largest video telematics solutions specialist in terms of subscribers and the company was the first to surpass 1 million vehicle subscriptions for video telematics specifically. Among the general fleet telematics players, Samsara stands out as a front-running video solution provider with the largest number of camera units deployed across its subscriber base. Additional sizable players include the fleet management provider Motive (formerly KeepTruckin), the hardware-focused video telematics company Howen, the channel-focused brand Xirgo (formerly Sensata INSIGHTS, including the acquired video telematics company SmartWitness) and the video telematics player Netradyne, all having installed bases of at least a quarter of a million units. The remaining top-10 players are VisionTrack and Nauto, which both have a primary focus on camera-based solutions specifically, as well as the fleet management provider Solera Fleet Solutions. The latter acquired the commercial vehicle telematics pioneer Omnitracs including the video safety specialist SmartDrive. Vendors with installed bases just outside of the top list moreover include LightMetrics and Nexar which are focused on camera-based solutions. Other noteworthy players competing in the video telematics space include video-focused solution providers such as Idrive, Waylens, SureCam, Seeing Machines and CameraMatics; fleet telematics players including Powerfleet, Forward Thinking Systems, Trimble Mobility (Platform Science), Radius, Matrix iQ, ISAAC Instruments, Microlise, Azuga, AddSecure Transport Solutions, Trakm8 and EROAD; as well as the hardware-focused supplier Pittasoft (BlackVue), which have all reached estimated installed bases in the tens of thousands.