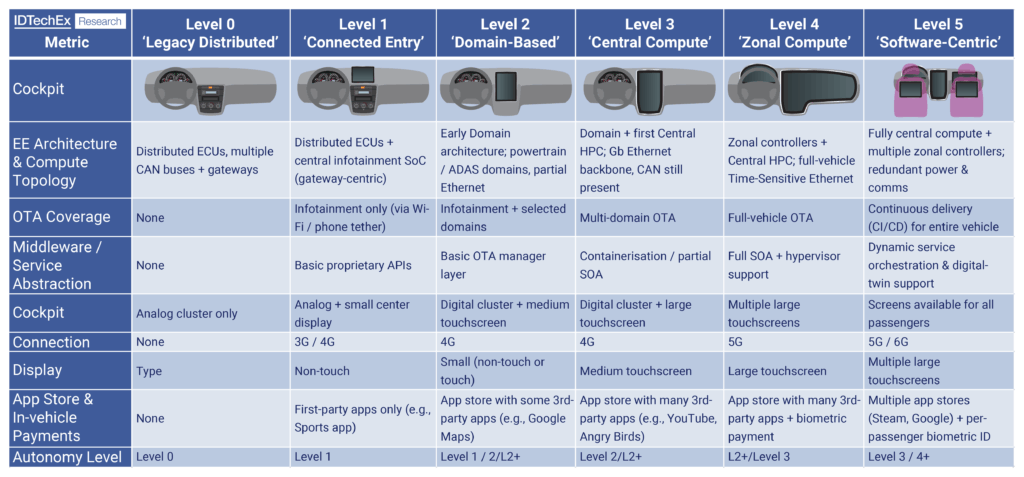

SDV Level Chart: IDTechEx defines SDV performance using six levels.

Most consumers still have limited awareness of the deeper value behind “software-defined” capabilities

The concept of the Software-Defined Vehicle (SDV) has rapidly emerged as a transformative trend reshaping the automotive industry. Yet, despite widespread use of the term, there remains significant confusion around its core meaning, structural elements, and real-world driving forces. Practically speaking, “SDV” serves as a catch-all phrase encompassing various technological advancements, from the evolution of E/E (Electrical/Electronic) architectures and decoupling software layers to reconfiguring operating systems. Simply put, if it involves flexible, software-driven deployment, it likely falls under the SDV umbrella.

Traditionally, the automotive industry attributes the rise of SDVs to increasing consumer expectations, such as smarter functions, personalized experiences, and seamless digital integration. However, according to the IDTechEx report “Software-Defined Vehicles, Connected Cars, and AI in Cars 2026-2036: Markets, Trends, and Forecasts“, without proactive marketing or consumer education from automakers, most users still have limited awareness of the deeper value behind “software-defined” capabilities.

Consumer demand remains largely rooted in tangible comfort and convenience features, like voice commands, navigation, or heated seats, rather than more complex digital services, such as AI assistants or in-vehicle e-commerce. Additionally, consumer familiarity with Over-The-Air (OTA) updates remains surprisingly low, resulting in slow adoption of subscription-based features.

From an industry perspective, however, the drive towards SDV is primarily motivated by internal imperatives such as cost reduction of wiring and validation, platform standardization, and data control. For automakers, SDV represents more than a shift in user experience; it’s a fundamental overhaul of vehicle development and system architectures.

Against this backdrop, the evolution of E/E architecture has become a fundamental enabler, transitioning from distributed architectures with over 70 electronic control units, several kilometers of wiring, and thousands of components, to domain control, then to zonal architectures and centralized computing platforms. The aim is to standardize platforms, shorten vehicle development cycles, reduce wiring complexity, and enable flexible function deployment through software configuration.

By standardizing hardware platforms across multiple vehicle models, automakers can flexibly differentiate features using software, enhancing profitability and market agility. Technologies such as Firmware Over-The-Air (FOTA) and Software Over-The-Air (SOTA) have become critical tools enabling long-term revenue generation through feature unlocks, subscriptions, and service monetization.

From a systems engineering standpoint, SDV is also driving a shift towards greater system cohesion. Legacy automotive systems, defined by isolated ECUs and fragmented development practices, are marked by complexity and limited integration. Conversely, SDVs are built around centralized, coherent software platforms where functions are orchestrated and coordinated through unified software layers. This centralized model significantly enhances maintainability, scalability, and supports advanced capabilities like real-time AI decision-making and edge computing.

At the middleware level, attention has been increasingly focused on frameworks such as AUTOSAR. Although AUTOSAR has long provided mature tools and modular standards, IDTechEx identifies several challenges facing its broader adoption. High licensing costs, steep learning curves, inconsistent implementation among vendors, and limited cross-toolchain compatibility present substantial hurdles, especially for smaller enterprises and startups entering the automotive software space.

Regarding architecture implementation, IDTechEx research highlights an emerging preference for zonal controllers paired with centralized computing platforms. Zonal controllers manage localized sensor inputs and actuator outputs, while centralized processors handle higher-order tasks like sensor fusion, strategic planning, and system coordination.

BMW‘s Neue Klasse architecture exemplifies this model, integrating high-performance computing (HPC) modules for ADAS, cabin management, vehicle dynamics, and powertrain control, interconnected via gigabit Ethernet for seamless task management. This setup enables flexible, service-oriented software deployment, simplifying updates and facilitating dynamic cross-domain interactions.

IDTechEx estimates that for a mid-to-high-end SDV, the hardware investment in centralized computing platforms and zonal controllers alone can exceed $2,000 per vehicle, with future architectural convergence expected to lower total wiring costs by $50-$200 per unit.

Some automakers, including Tesla, are pushing even further toward highly centralized architectures. Tesla utilizes dual-HPC designs consolidating virtually all vehicle functions into two primary computing nodes, delivering unprecedented integration and efficiency. Despite these advancements, IDTechEx notes that achieving the ultimate vision, often termed “Super Core” architecture, faces numerous technical, commercial, and regulatory challenges. Issues include managing power demands of advanced processors, ensuring robust safety compliance (ISO 26262 ASIL-D), and harmonizing software update cycles across diverse vehicle systems.

In the IDTechEx report“Software-Defined Vehicles, Connected Cars, and AI in Cars 2026-2036: Markets, Trends, and Forecasts”, IDTechEx provides a systematic analysis of the deployment pathways of typical vehicle SDV architectures, along with market research findings on future architecture transition timelines, sales forecasts, and key hardware market opportunities. The global annual revenue from software related to connected and software-defined vehicles is projected to exceed US$700 billion by 2034, with a forecasted CAGR of 34%.

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/SDV, or for the full portfolio of research available from IDTechEx, see www.IDTechEx.com.

Shihao Fu

Technology Analyst, IDTechEx