This market research report was originally published at Yole Développement’s website. It is reprinted here with the permission of Yole Développement.

The automotive industry faces new industrial and technological challenges while undergoing dramatic changes in its value chain.

OUTLINE

-

Market forecasts:

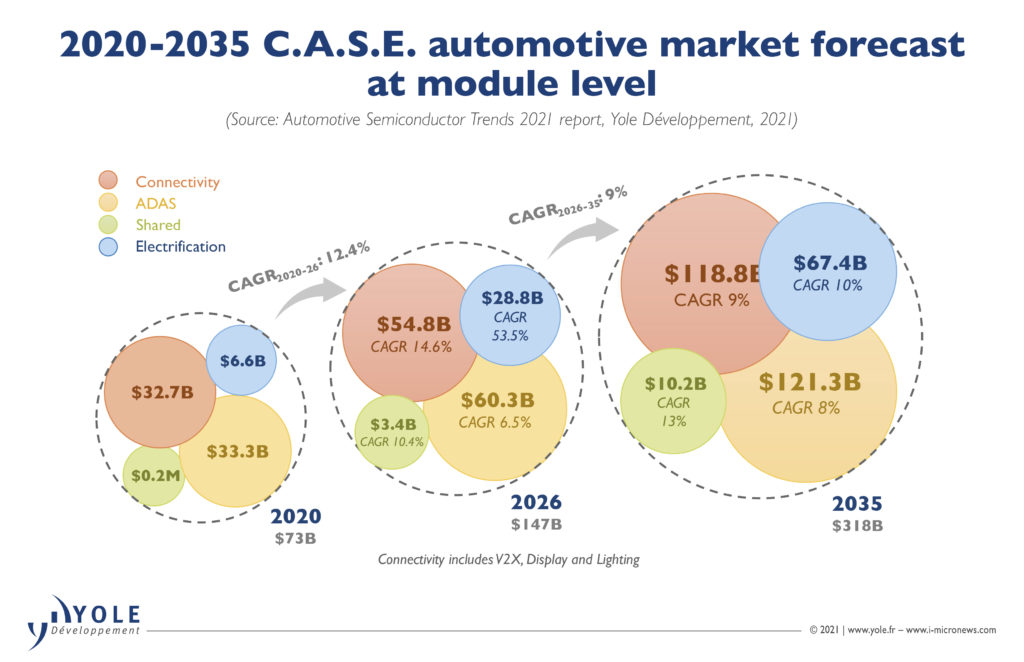

In 2035, C.A.S.E. will be a US$318 billion market.

Semiconductor’s value (chip level) in car will reach US$78.5 billion in 2026, with a 14.75% CAGR 2020-2026.

-

Technology trends:

Connectivity: Future V2X communication platforms for 5G implementation are being designed today, and solutions are expected for 2024. In the meantime, initial solutions are starting to appear with dual-4G and forward-compatible 5G capabilities.

ADAS: Radars and cameras are the main sensors used by OEMs as they are quite performant and relatively cheap. For a few years, LiDAR sensors have been slowly entering the automotive industry to provide more automated driving functions.

Sharing: New habits related to cars are emerging and Gen Y now desire connectivity, convenience and the possibility to choose from different range of transportation from A to B. They are shaping an industry in which in-demand car service providers are growing.

Electrification: OEMs have announced their investment plans for the next 5 years which exceed US$250 billion worldwide. The timeline for cars electrification is very aggressive, as in 15 years OEMs will have to develop an entire car portfolio that will be fully electric.

-

Supply chain:

Supply chain management will change due to chips shortage, an increasing semiconductor content and electrification.

OEMs have to negotiate directly with chip manufacturers, learn from the consumer industry and keep “buffer stock”.

Traditional OEMs (Audi, Hyundai, etc…) are facing disruptive OEMs (Tesla, Apple…).

China is intensifying the competition and invests massively in semiconductors and in the automotive industry.

“The value of semiconductors, at the chip level, in cars will grow from US$34.4 billion in 2020 to US$78.5 billion in 2026, a 14.75% CAGR.” asserts Eric Mounier, PhD, Director of Market Research at Yole Développement (Yole). He adds: “The largest growth will be in EVs due to the major shift to electrification.”

A car has today, on average, US$450 worth of semiconductors. In 2026, it will be US$700. Automotive developments are driven by technological developments for C.A.S.E. Yole’s analysts have estimated the C.A.S.E. related electronics modules market evolution to be:

- Connectivity: from almost US$33 billion in 2020 to almost US$55 billion in 2026, with 14.55% CAGR 2020-2026

- ADAS will reach more than US$60 billion in 2026 with 6.50% CAGR 2020-2026

- Sharing will reach about US$3 billion in 2026 with 10.39% CAGR 2020-2026

- Electrification will reach US$28,804 million in 2026, with 53.45% CAGR 2020-2026

- In 2035, C.A.S.E. will be a US$318 billion market.

In this context, the market research and strategy consulting company investigates disruptive semiconductor technologies for the automotive sector in depth. Its aim is to point out the latest innovations and underline the business opportunities.

These investigations have been developed with Yole’s partner, System Plus Consulting. According to Wilfried Théron, Electronic System, Department Director & Quality Manager at System Plus Consulting: “System Plus Consulting’s Teardowns uncover innovative design features and new semiconductor components to guide enterprises toward more streamlined solutions in future designs”. They provide clients unmatched intelligence into 4 automotive tracks (ADAS, Electrification, Infotainment and Telematics).

In addition, Yole releases today, the Automotive Semiconductor Trends 2021 report to provide an in-depth understanding of the changing automotive industry ecosystem and supply chain players. Including market trends and forecasts, take away and outlook, this study proposes key technical insights and analyses about future technology trends and challenges.

What are the economic and technological challenges of the automotive industry? What are the factors affecting the durability of the car industry? What are the key market drivers? Who are the companies to watch, and what innovative technologies are they working on? What are the recent investments and collaborations?

Today, Yole’s analysts present their vision of the automotive semiconductor trends.

As analyzed by Yole’s team in the new Automotive Semiconductor Trends 2021 report, wafer shipments will grow from 20 million to more than 45 million, with 8’’ being the most used wafer size. The 20nm node and below will be driven by ADAS and infotainment applications.

For Eric Mounier: “Today, most of the wafer production for automotive is for 130/180 nm and more, and leading-edge technology is very scarce. But 40nm and 28nm are used for the Mobileye EyeQ3 and EyeQ4 for ADAS and autonomy. Memory for infotainment and ADAS use 10-14 nm. In the future, 7nm could be used for ADAS. The current chip shortage mainly affects nodes in the 40-180nm range”.

The development of electric vehicles and self-driving technologies naturally attracts OEMs and Tier-1 component suppliers. Therefore, new OEMs like Nio, Xpeng, and Lucid Motors, among others, have recently entered the industry. Other players coming from the semiconductor or the consumer industries will enter the field as well. In this race to full autonomy, large OEMs with many resources – like Volkswagen – will develop the necessary software by themselves or partner with or acquire robotic vehicle companies. Generalist OEMs with few resources are expected to rely on Tier-1s to develop basic automated driving features. These Tier-1s will have to master camera, radar, LiDAR sensors, and the computing.

According to Pierrick Boulay, Technology & Market Analyst, Solid-state Lighting at Yole: “Companies from the semiconductor side, like Qualcomm, Nvidia, and Intel-Mobileye, are positioning themselves, sometimes through acquisitions, at the center of automated driving systems. For example, Qualcomm is in talk to acquire Veoneer to reinforce its position in the automotive industry”.

Companies coming from the consumer industry, like Apple, Huawei, or Xiaomi, are also entering the market. Depending on their strategy, they could develop only the self-driving part or the entire electric car, like Huawei is doing. Foxconn, which is known for its assembly role in the Apple supply chain, is partnering with several companies such as Apple and Stellantis and is increasing its automotive-related business. This new role of subcontractor, like Foxconn, is growing, and a recent partnership between Fisker and Magna showed that Magna will assemble the car. In the future, it could be possible to see new automotive OEMs being fabless and relying on the experience of subcontractors.

The COVID-19 crisis has emphasized the increasing importance of semiconductors in cars. Companies coming from the semiconductor and software sides have strong financial power and could acquire some Tier-1s or Tier-2s’ companies. This could reshape the automotive landscape in the coming years.

All year long, Yole Développement and System Plus Consulting publish an impressive collection of reports and monitors.

Experts realize various key presentations, organize key conferences and interview leading industrial companies.

In this regard, do not miss SEMI Smart Mobility Forum 2021. Eric Mounier PhD, Director of Market Research at Yole Développement will present “Automotive Semiconductor Trends” on September 24, 2021. Register here!

Analysts aim is to deliver key results and technology and market trends and explain the major changes. Do not hesitate to read System Plus Consulting’s interviews by EETIMES:

- EETIMES – Under the Hood: the Innovation-Rich Golf 8

- EETIMES – Under the Hood: the ID.3 and VW’s electrification platform

Make sure to be aware of the latest news coming from the industry and get an overview of our activities, including interviews with leading companies and more on i-Micronews. Stay tuned!

Extracted from:

- Automotive Semiconductor Trends 2021 report, Yole Développement, 2021

- Automotive Teardown Track, System Plus Consulting

Acronyms:

- C.A.S.E.: Connectivity, ADAS, Sharing, Electrification

- CAGR: Compound Annual Growth Rate

- OEM: Original Equipment Manufacturer

- ADAS: Advanced Driver Assistance Systems

- LiDAR: Light Detection and Ranging